Pork Outlook: Hog prices trending upwards for 2026

EU pork production is expected to decline after African Swine Fever detected near Barcelona

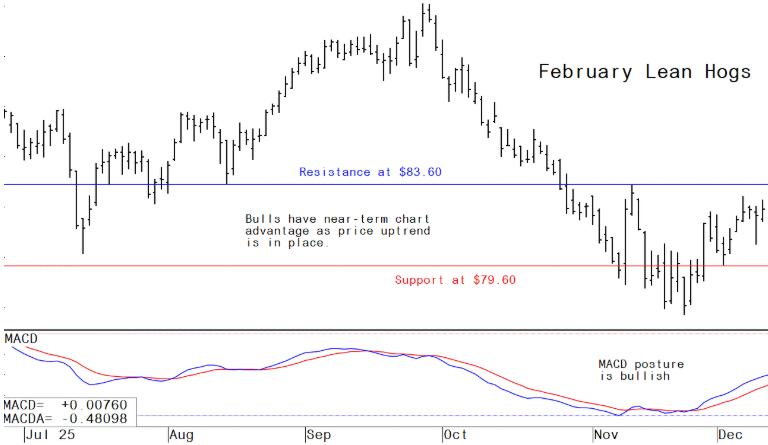

Lean hog futures prices are trending up and bulls have the advantage. February lean hogs on Wednesday rose 55 cents to $82.425. Hog futures saw some modest technical buying as the near-term chart posture for the market has turned bullish. Hog traders are also reckoning the cash hog market has put in a seasonal bottom, which is keeping a floor under futures prices. The latest CME lean hog index is up 5 cents to $81.89. Thursday’s projected cash index price is up 27 cents at $82.16.

Pork industry and related news

USDA’s latest world outlook shows shrinking exportable supplies for poultry and red meat, while poultry surges on competitive pricing and expanding production.

USDA’s Livestock and Poultry: World Markets and Trade report released Dec. 9, paints a sharply diverging picture for global meat markets in 2026. Exportable supplies of beef and pork are forecast to contract, weighed down by tighter production cycles, disease constraints, and market-access frictions. By contrast, chicken meat shipments are projected to hit a new all-time high, powered by Brazil and China’s expanding, cost-competitive output.

The data — drawn from the Foreign Agricultural Service’s global database — underscores widening structural differences among protein sectors as producers confront feed-cost normalization, herd rebuilding, animal disease pressures and shifts in major importers’ demand.

Pork: EU production declines again, limiting global supplies. Global pork production in 2026 is projected to be effectively unchanged at 117.2 million tons, as growth in Vietnam, Brazil and Mexico is offset by another year of contraction in the European Union, where costs and new ASF discoveries strain producers.

Trade shifts are again shaped by China, though far less dramatically than during the African swine fever shock of 2019–21. Pork exports among major suppliers are projected to fall 1% to 10.3 million tons as EU shipments drop 7% — the largest decline of any major exporter.

Highlights:

- Brazil continues its steady rise, with exports forecast up 4% to 1.8 million tons.

- Canada edges up 1% as it diversifies away from China.

- US exports rise 1% to 3.2 million tons, supported by competitive pricing and growing Central American demand — plus new access to Malaysia.

- China’s import needs are stabilizing near pre-ASF norms, knocking the global pork market into a far more mature, supply-limited equilibrium.

Malaysia halts most Spanish pork imports after African swine fever detected

Kuala Lumpur imposes immediate restrictions, allowing only limited certified products

Malaysia has imposed an immediate ban on most pork and pork-product imports from Spain after African swine fever (ASF) was confirmed in wild boars near Barcelona late last month. The country’s Veterinary Services Department said Friday the restrictions apply broadly but exclude retort (heat-sterilized) products.

Spanish pork may still be imported under tightly defined conditions: consignments must carry a veterinary health certificate issued on or before Nov. 28 confirming the animals were slaughtered before Nov. 14 and processed before Nov. 28.

The move follows multiple ASF detections in Spain and reflects Malaysia’s effort to prevent the virus from entering its domestic herd. The next week’s likely high-low price trading ranges:

February lean hog futures--$80.65 to $85.00 and with a sideways-higher bias

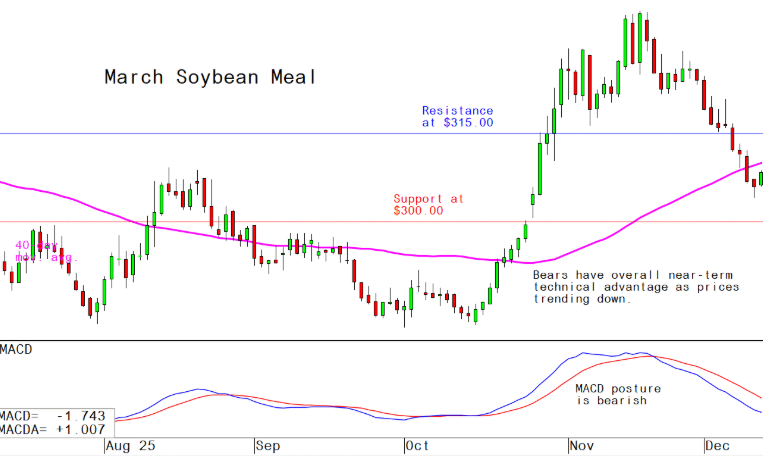

January soybean meal futures--$295.00 to $315.00, and with a sideways bias

March corn futures--$4.41 3/4 to $4.52 1/4 and a sideways bias

Latest analytical daily charts lean hog, soybean meal and corn futures