June Hogs and Pigs Report: pandemic, feed costs & Prop 12 impacts on market

Alton Kalo discusses the implications of USDA's June 2022 Hogs and Pigs ReportAlton Kalo, Chief Economist with Steiner Consulting Group, discussed the results of the Hog and Pigs Report released June 30th specifically addressing future supplies and pricing. Following are his insights:

Report Revisions

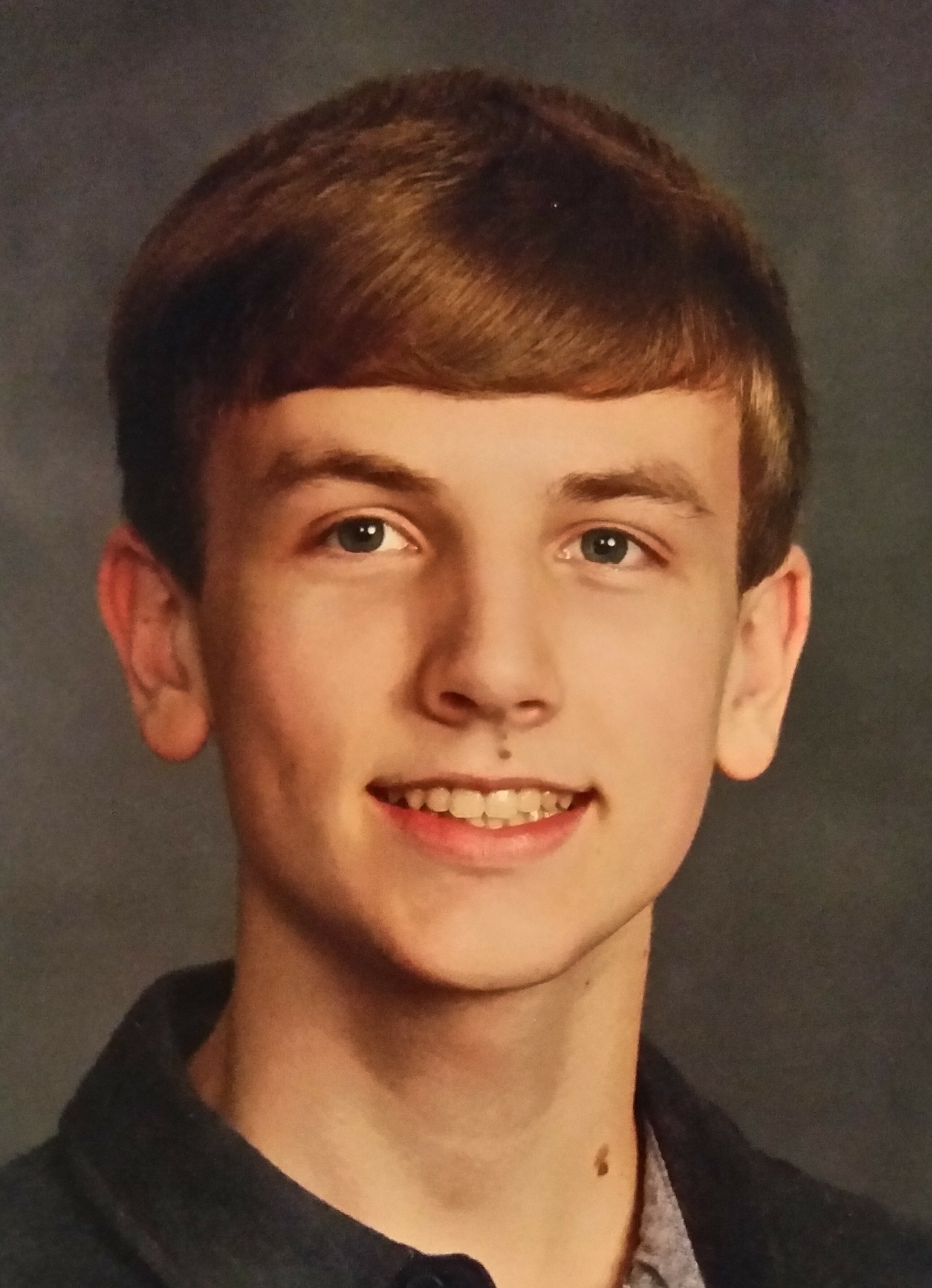

USDA revisions to estimates:

- March 1 market hog inventory revised up 410,000 head or 0.6%

- Pig crop for Sep-Nov was revised up by 411,000 head or 1.2%, attributed to better farrowings

- Pig crop for Dec-Feb was revised up by 123,000 head or 0.4%, attributed to higher farrowings

Report Analysis

Key numbers in the report:

- Total inventory is down 0.9% from last year

- Breeding herd is down 0.8% from last year

- Number of market hogs is down 0.9% from last year

Weekly hog slaughter trends:

- Experiencing usual seasonality: higher in the fall and winter, lower in the spring and summer

- Early to mid-July is 0.8% lower than last year; weekly slaughter is a little ahead of USDA estimates

- Mid-July through late August expected to have 0.7% lower supplies: about 10,000-15,000 head less than last year

- September through early October expected to have 0.6% lower supplies than last year

- Mid-October through late November expected to have 1.3% lower supplies: about 30,000-35,000 head less than last year

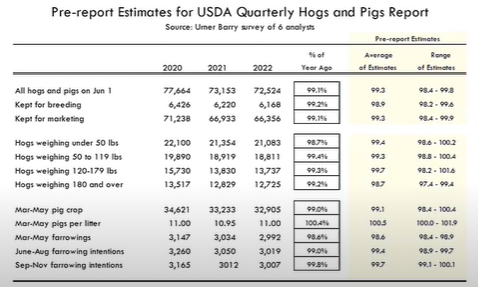

Hogs kept for breeding - quarterly inventory:

- Breeding herd dropped about 7% from December 1st, 2019 to March 1st, 2022 due to the pandemic and higher feed costs

- Breeding herd is about 1.1% lower than last year: about 6.168 million head

- About 70,000 head higher than in March 2022

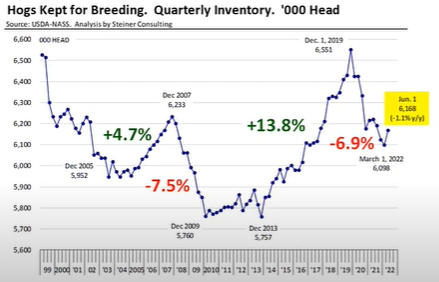

Y/Y change of gilt retention:

- Implied gilt retention is about 5% lower than last year

- Actual gilt retention is 2.5% higher than last year due to herd liquidation, producers profiting February through May ($25/head) even with higher feed costs, and Proposition 12 coming into play

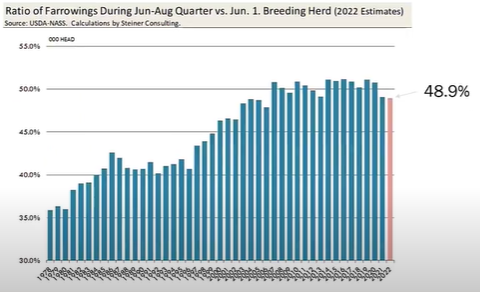

Ratio of Jun-Aug farrowings to June 1 inventory:

- June-August pig crop helps predict the expected supply in December-February

- Ratio of farrowing cases to breeding herd on June 1st was 48.9%

- Farrowing intentions are lower compared to 2021

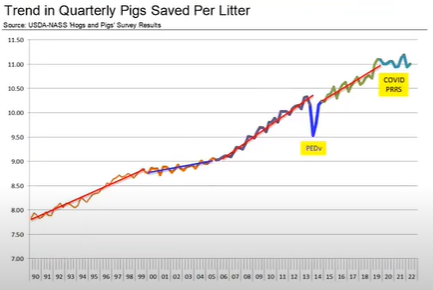

Productivity measures - pigs per litter:

- Producers can improve the productivity by farrowing better or having more pigs per litter

- Upward trend for the past 30 years in number of pigs saved per litter

- In the last couple years, the number of pigs saved per litter has flattened out due to the pandemic and ongoing pig disease pressure

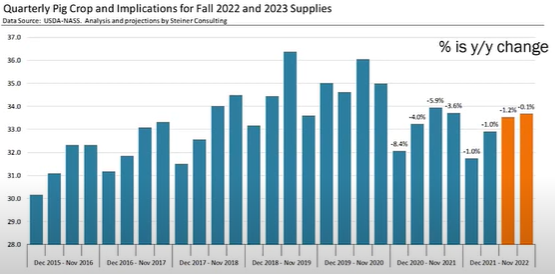

Pig crop for Mar-May and expectations for Jun-Aug and Sep-Nov:

- March-May pig crop was down 1% from last year

- June-August pig crop is expected to be down 1.2% from last year

- September-November pig crop (will go to market next spring) is expected to be similar to last year