Pig outlook — Lean hog futures bears have strong grip

Learn more about the global pig marketFebruary lean hog futures this week hit a new contract low and a price downtrend on the daily bar chart has been restarted. That suggests more downside price pressure in the near term as the bears have the solid near-term technical advantage. The latest CME lean hog index rose 14 cents to $65.19 (as of Jan. 2). Hog market bulls are still hoping for a seasonal low in prices coming soon. Keener risk aversion in the general marketplace to start 2024 is also weighing on ag markets, including hogs.

California's Proposition 12 has officially become law

The law marks the culmination of over six years of political efforts by animal activists. Proposition 12, which was passed by California voters in 2018, imposes strict regulations on the sale of food products derived from farm animals that are not raised according to specific standards. While the egg and veal requirements of Prop 12 had already gone into effect, the pork provisions were initially delayed to allow non-compliant pork to clear the supply chain. As of Jan. 1, 2024, only compliant animal products can be sold in California.

The pork industry opposed Proposition 12 and took the legal battle to the Supreme Court, which ultimately ruled that states have the authority to restrict meat sales.

USDA modified a weekly report on hog marketings to show the premium that was being paid for hogs raised in compliance with “animal confinement legislation,” such as Prop 12. In late December, the premium was an average $4.92 per 100 pounds.

Since the passage of Proposition 12 in California, 14 other states have enacted similar laws.

African swine fever continues to rise in the EU

African swine fever (ASF) entered five new European countries in 2023, according to a report from ISN, the interest group for pig production in Germany. Total cases across the EU were well above the previous year's level. With a total of 12,121 outbreaks, the numbers have almost doubled compared to 2022. ASF cases in wild boars in Europe have increased slightly. Poland remains the country most affected by ASF.

In 2023, ASF has moved into five new countries. Outbreaks occurred for the first time in Greece, Croatia, Kosovo, Bosnia-Herzegovina and Sweden. In Greece and Kosovo, it was apparently a point entry, as the virus no longer spread there.

Case numbers in domestic pigs have risen dramatically. In Croatia and Bosnia-Herzegovina, the virus broke out in domestic pig herds for the first time in 2023. With more than 1,500 cases, Bosnia-Herzegovina records the highest number of cases. The events are currently still acute. More than 1,100 cases were also reported in Croatia, followed by Serbia with more than 900 affected domestic pigs and Romania with more than 700 cases. Overall, the total number of ASF outbreaks in Europe among domestic pigs with 4,500 is significantly higher than the total number from 2022 with 515 cases.

ASF levels in the wild boar population are similar to those of 2022. The biggest outbreaks occurred in Poland. By the end of the year, ASF cases had reached 2,624. Italy reported 1,009 cases, Germany reported 880, and Latvia declared 718 positive cases.

In Germany, the number of ASF cases is on the decline, according to ISN. The number of ASF cases in wild boars continues to decrease; as a result, restriction zones could be partially reduced or dissolved in the affected federal states.

Since the beginning of the year, the Friedrich Loeffler Institute has detected 880 ASF cases in wild boars and one case in a domestic pig population. Occurrences in Germany were limited to the districts of Görlitz and Bautzen in Saxony as well as Spree-Neiße, Uckermark and Oberspreewald-Lausitz in Brandenburg near the Polish border.

China approves GMO corn and soy

China has approved a first batch of seed companies to breed and sell genetically modified corn and soybean seeds, paving the way for commercial planting of GMO grains in a move that could cut its reliance on imports from the US and Brazil, reported Reuters. The Ministry of Agriculture and Rural Affairs in a notice dated Dec. 25 issued licenses to 26 local companies to produce, distribute and sell the GMO seeds in certain provinces. The companies named include Beijing Dabeinong Technology, subsidiaries of Yuan Long Ping High-Tech Agriculture, and China National Seed, now owned by Syngenta Group. Other licensed companies include those operating in the major grain-producing provinces of Hebei, Liaoning, Jilin and Inner Mongolia.

This is China's first batch of companies to receive seed production and operation licences for GMO corn and soybeans, the GLOCON Agritech Co-Innovation Institute said in a note. Though cautious about GMO technology, Beijing has been slowly moving to open up the market. It has approved more than a dozen genetic changes since 2019. The world's biggest buyer of soybeans and corn wants to reduce its reliance on imports amounting to more than 100 million metric tons a year to feed its livestock. Commercial planting of GMO varieties will boost yields and could significantly lower future purchases from the United States and Brazil. Three industry sources told Reuters this month that Chinese corn breeders are preparing for the planting of about 670,000 hectares of GMO corn in eight provinces next year, more than double the amount planted in 2023. But Beijing is still expected to tightly control the rollout of GMOs. Large-scale trials of GMO soy and corn were carried out this year, which the agriculture ministry said showed "outstanding" results and that the technology was safe and essential.

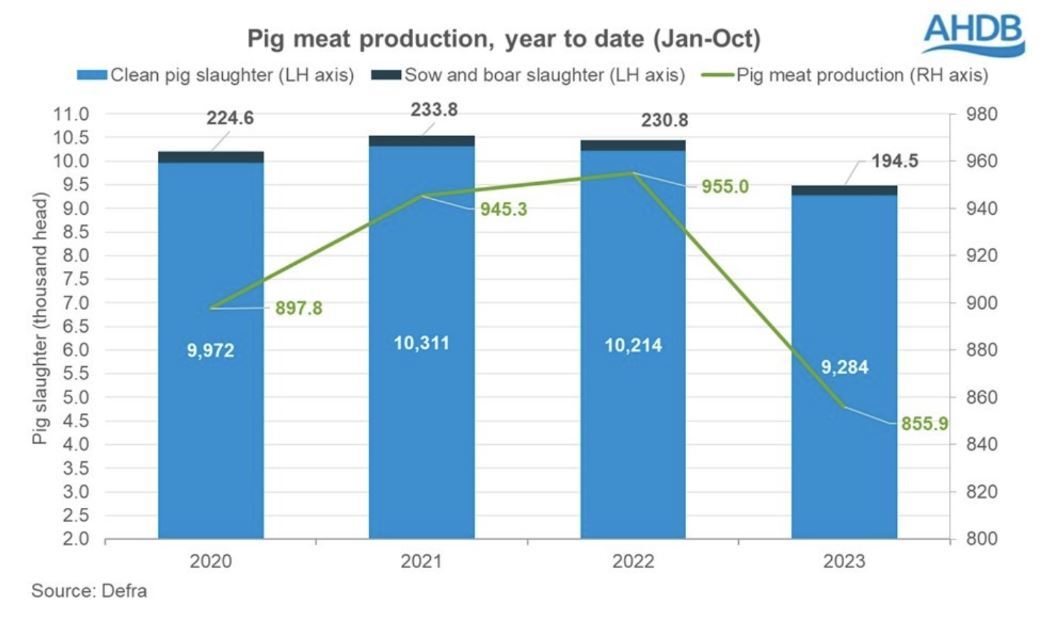

2023 UK pig production falls below 2022 levels

Pig meat production remains below levels seen last year, with November production sat at 85,200 tonnes, according to a recent market report from the UK's Agriculture and Horticulture Development Board (AHDB). Although this is a slight elevation of 2,500 tonnes (3%) from the previous month, driven by increased slaughter, it is a fall of 3,200 tonnes (3.6%) from November 2022 . Increased production may be a result of more shoppers choosing to eat gammon over Christmas.

Clean pig slaughter numbers have grown to 910,500 head in November, an increase of 2.6% from October with reports of pigs being brought forward ahead of Christmas. However, numbers are down 45,900 head (4.8%) from the same time last year and 36,100 head (3.8%) behind the five-year average, as the population of fattening pigs continues to decline. Clean pig slaughter year to date (Jan – Nov) sits at 9.28m head, a drop of 9% (930,000 head) from the same period in 2022.

The next week’s likely high-low price trading ranges:

February lean hog futures--$62.00 to $70.00 and with a sideways-lower bias

March soybean meal futures--$360.00 to $395.00, and with a sideways-lower bias

March corn futures--$4.47 to $4.75 and a sideways-lower bias

Latest analytical daily charts lean hog, soybean meal and corn futures