Pig outlook: Lean hog futures prices trending up

Hog prices looking to increase in the near future

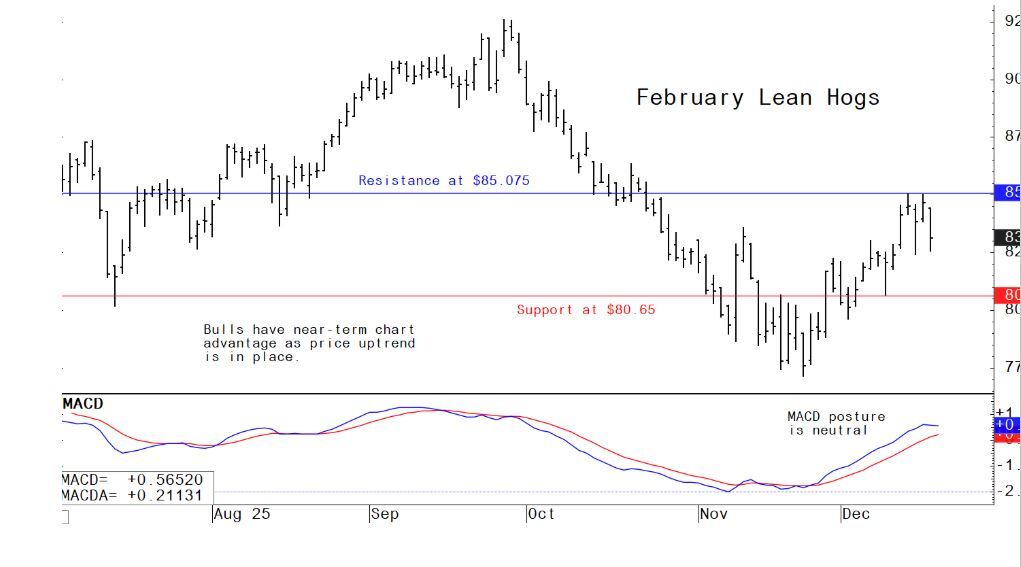

February lean hogs on Wednesday fell $1.775 to $83.00. Hog futures saw heavy profit-taking pressure, following recent gains that pushed prices to a six-week high earlier this week. The near-term chart posture for the market remains bullish as prices are still in an uptrend. Recent gains in the cash hog market and the CME hog index also suggest seasonal bottoms are in place for cash and futures markets. The latest CME lean hog index is up 31 cents to $83.30. Today’s projected cash index price is up another 57 cents at $83.87. Wednesday’s national direct 5-day rolling average cash hog price quote is $71.10.

Mexico opens trade probe into US pork imports

Anti-dumping and subsidy investigation raises fresh uncertainty for US producers despite USMCA protections

Mexico’s Economy Ministry has launched anti-dumping and anti-subsidy investigations into imports of US pork leg and shoulder, a move that could ultimately result in new duties on the products, according to a government document released Monday.

The probe will examine whether US pork exports harmed Mexico’s domestic pork industry between 2022 and 2024, following petitions filed by five Mexican pork producers. The petitioners allege that US pork was sold under conditions of price discrimination and supported by subsidies, pressuring domestic prices and eroding profitability and returns on investment for Mexican producers.

Details: According to a report from Noticias Financieras, the investigation covers imports from Jan. 1-Dec. 31, 2024, and a period of Jan. 1, 2022-Dec. 31, 2024, as the injury period in the exam. Companies asking for the probe said they cited a range of subsidies that were provided by the US government, state governments, and the US pork industry. The total imported volume of pork grew 10% over the 2022-2024 period, including a 1% rise in 2023 and a 9% increase in 2024, while domestic production grew 1% in 2023 and 7% in 2024, according to the report, with imports from seven different countries with the US holding 86% of the shipments.

The industry contends the imports captured nearly all the demand growth for pork, forcing Mexican producers to find other markets that were not TIF (Tipo Inspección Federal) markets. The TIF is a strict government certification process for meat processing plants which facilitate the products entering international commerce.

The rise in imports meant that the excess production was forced to be put into non-TIF markets where the companies said can result in lower prices received for the product as the non-TIF markets are ones where consumers are not willing to pay the costs involved in meeting the TIF process, the report said.

NPPC responds. “Our industry prides itself on fair business practices with all our international markets, and we are disappointed the Mexican government is moving forward with this investigation,” Maria C. Zieba, vice president of government affairs at the National Pork Producers Council, said in a statement. She added that NPPC is reviewing the petitions and emphasized that Mexico is a major US pork market with “decades-long partnerships.”

The Economy Ministry said it elected to open the investigation based on the producers’ filings. USDA and the Office of the US Trade Representative did not respond to requests for comment.

Any duties imposed because of the investigation would come despite the US-Mexico-Canada Agreement, signed during President Donald Trump’s first term, which generally eliminates tariffs on qualifying goods traded among the three countries.

China cuts pork duties on EU imports after lengthy probe

Final anti-dumping ruling sharply lowers tariffs, easing pressure on European exporters while offering modest support to China’s struggling hog sector

China has significantly reduced tariffs on pork imports from the European Union, delivering partial relief to European producers after an 18-month anti-dumping investigation that was widely viewed as retaliation for EU duties on Chinese electric vehicles.

In its final ruling released Tuesday, China’s Ministry of Commerce set new tariffs ranging from 4.9% to 19.8% on EU pork imports for a five-year period starting Wednesday. The move marks a sharp rollback from preliminary rates of 15.6% to 62.4% imposed in September. Importers will be refunded the difference on duties paid since the provisional decision.

The ruling affects more than $2 billion in EU pork exports to China and comes as a relief to producers that rely heavily on the Chinese market, particularly for offal such as pig ears and feet, which have limited demand elsewhere. China imported $4.8 billion worth of pork and offal in 2024, with over half sourced from the EU. Spain was the bloc’s largest exporter by volume.

The investigation, launched in June 2024, hit major exporters including Spain, the Netherlands and Denmark. It unfolded alongside broader diplomatic engagement, including renewed talks on EV tariffs and recent visits to Beijing by French President Emmanuel Macron and Spain’s King Felipe. Spanish regional officials also pressed for tariff relief, citing Spain’s openness to Chinese investment in autos.

Industry groups welcomed the lower rates but stressed they still represent a cost. France’s pork association Inaporc said all cooperating exporters were granted a 9.8% rate, offering “a sense of relief,” though not something the industry could celebrate outright.

The decision comes as China’s domestic hog sector struggles with oversupply and weak consumer demand. Pork prices have fallen throughout 2025 and are expected to remain under pressure. While the reduced duties may slightly lift imported pork prices and ease food price deflation, analysts say the impact will likely be modest — benefiting Chinese pig farmers more than price-sensitive import segments.

China continues to wield trade tools elsewhere against the EU, with an anti-subsidy investigation into EU dairy exports due to conclude next February and tariffs already imposed on EU brandy, underscoring that trade tensions between Beijing and Brussels remain far from resolved.

The next week’s likely high-low price trading ranges:

February lean hog futures--$82.00 to $86.00 and with a sideways-higher bias

January soybean meal futures--$295.00 to $310.00, and with a sideways bias

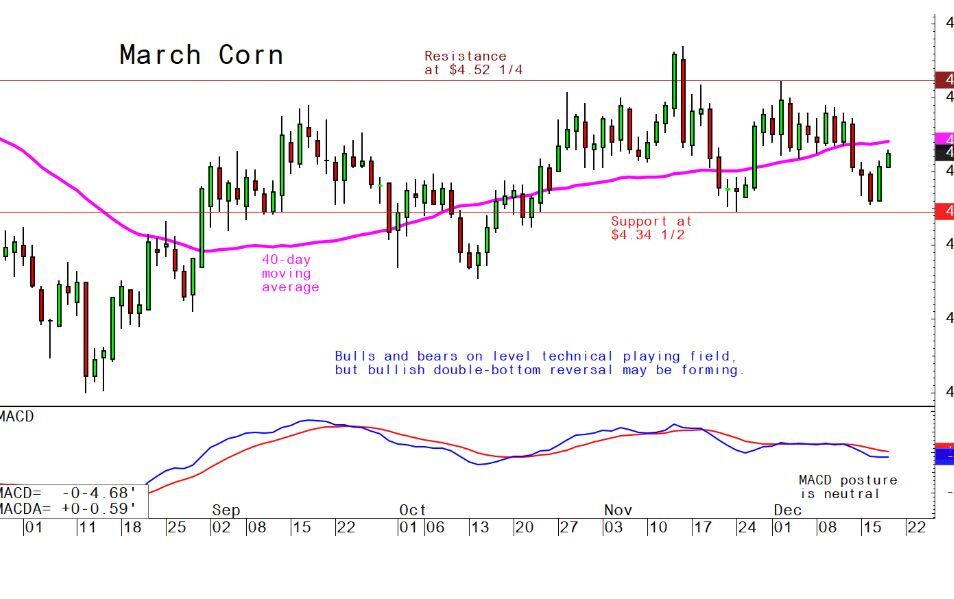

March corn futures--$4.34 1/2 to $4.52 1/4 and a sideways-higher bias

Latest analytical daily charts lean hog, soybean meal and corn futures