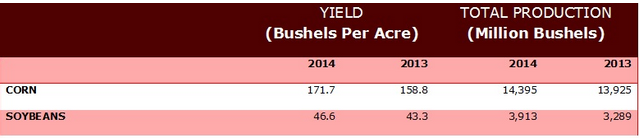

Pork Commentary: Record Corn and Soybean Yields

US - The pork sector got some news on Thursday that will almost guarantee lower feed costs over the next twelve months (compared to the last few years).The USDA on Thursday came out with estimates of record corn and soybean yields and production.

The USDA estimates World ending stocks of corn at 189.9/mt the highest since 1986 – 87 or 18 years ago. USDA estimate of soybean ending stocks of 90.2/mt is one of the highest on record.

Our Cowboy Arithmetic: Huge Crops – Huge Ending Stocks means lower feed prices as not only US has large crops, the World ending stocks says the World doesn’t need US feed stocks.

As we wrote a couple of weeks ago, China has 5 billion bushels of corn in storage. Over the last year China has liquidated four million sows. They have corn and their feed needs are definitely dropping. It’s hard to believe China will be importing much US corn or DDG’s, bet on the GMO issue with China not going away this crop year. There will be little export relief from China for corn farmers.

Also, 4 million less sows in China – less soybean meal needs.

The huge crops and world ending stocks are weighing on prices. CBOT December Corn closed Friday at $3.38 a bushel – a new contract low. At the first part of May this year December corn was over $5.00 a bushel. The lowest cash corn market in the US last Friday was North Dakota/Minnesota at $2.41 a bushel. How low can corn go?

Soybean meal on CBOT December last Friday closed at a new contract low of $324 a ton, in May this year CBOT December soybean meal was over $400 a ton.

Since May feed costs to produce a farrow to finish market hog has decreased over $25 per head.

There is no doubt there will be relative inexpensive feed in the 2014 – 2015 crop year. At current lean hog futures and projected feed costs over the next twelve months, estimated profit for a farrow to finish hog operation is over $50 per head. Has it ever been better?!

PED

Last week it was announced that PED had struck Circle four in Utah, probably the largest single site .PNG)

Question is with the Government insisting on mandatory reporting is that leading to more or less reports? If PED rampages this coming winter like last year, next summer lean hog futures are way undervalued. We would expect $1.30 lean hogs if PED hits with similar intensity. Two main reasons pork supply will be tempered from PED and we expect China due to its 4 million sow liquidation (60 million less hogs?) will be big pork buyers.

A reflection of supply and demand of pigs is the cash sow and feeder pig markets. Cash sews last week averaged $60.57 up $2.00 from the week before. Cash feeder pigs 40 pounds averaged $79.95. DTN – Agdayta does a daily calculation of what you pay for feeder pigs, last Friday it was $85.26. We suspect cash sews and feeder pigs will have a $10 increase per head in the next four weeks as the market starts chasing supply.

Summary

We will have lots of corn – soybeans. Feed prices will be low relative to the last few years. We see little sow herd expansion and if PED unleashes the hell like this year, summer futures are way, way undervalued. In our opinion, even without PED next summer lean hogs will be over $1.00 as in our opinion, China will be a big buyer of pork next year.

China’s market is already starting to move up. On the first of July China’s hog price was 97? US liveweight equivalency a pound. Now it’s $1.10. The US hog price is now 40¢ a pound lower than China’s and will start pushing pork to China. In our opinion, we are just at the beginning in China’s expected production freefall.