CME: Is the Hog Situation This Fall Tight Enough to Cause Trouble?

US - "Oh no, 1998 is happening again!" 0"We are going to run out of hog slaughter space this fall!" 0 0Those are a couple of the comments we have been hearing in recent weeks and we think they should be addressed in the context of Friday’s USDA Hogs and Pigs report, write Steve Meyer and Len Steiner.Here are what we think are the relevant questions — and answers as far as we can see.

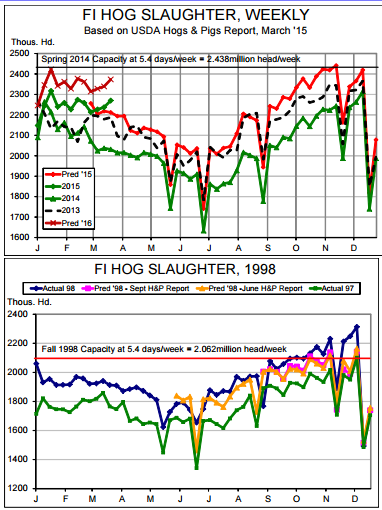

What is current capacity? The top chart is the best answer we can offer for that one. DLR author Dr Steve Meyer surveys pork packers each spring and asks “How many hog could you slaughter on a weekday if hogs are plentiful and margins are good?”

That survey has not been done yet this year but the aggregate answer last year was 451,520. History tells us that the sector can usually run 5.4 days/week (with the extra coming from Saturday operations) without have a big impact on hog prices. That figure puts weekly capacity at 2.438 million head.

Dr Meyer’s survey will commence soon and he expects this figure to rise slightly due to a few operational changes at existing plants. There are no new plants in operation and there has been no major expansions of any plant since last spring.

Will this capacity handle the hogs likely to come from Friday’s report? The chart also shows weekly slaughter for 2013, 2014 and projected slaughter for 2015 based on Friday’s report. It includes the report’s 6.7 per cent year-on-year increase in Dec-Feb litter size for the Mar-May and June-Aug quarters.

If anything, that inclusion may overstates supplies from December onward but recall that the litter size graph in yester? day’s DLR showed a considerably large gap between observed litter sizes and the long term trend of litter size growth — even with the litter rate recovery for the most recent quarter. So, we think these forecasts are, if anything, generous but we believe they are reasonable as well — and they still barely get to the 2.438 million head level.

Is the situation this fall tight enough to cause trouble? We do not think it is. That capacity constraint is pretty fuzzy. Plants can push a few more hogs through by adding, say, one or two hours per shift or adding Saturday shifts for a short time. The US packing sector exceeded “rated” capacity by a significant amount for several weeks in the fall of 2007 and in all but two non?holiday weeks from September onward in the fall of 2008. Prices were lower in both of those periods but not disastrously so. We do not see this fall being a big problem if the USDA inventory and intention numbers in Friday’s report are right.

How does this compare to 1998? It pains us greatly to even re-visit that period which saw cash hog prices fall to $8 per cwt. live weight, their lowest level since the Depression. There were several factors the drove that decline. First, capacity was indeed exceeded. Second, the number of hogs available far exceeded what both the June and September reports predicted. Third, our demand base was not nearly so large then meaning we had fewer options for selling such a large amount of pork.

Does this mean we are “out of the woods”? Absolutely not. Note the “Pred 2016” line in the top chart. Those levels are close to capacity in the first quarter of the year! A normal seasonal pattern would put slaughter back to those levels in September and then add 100,000 to 200,000 per week by November. The new plant in Michigan will not be operating until late 2017 at the earliest and not likely until 2018. A rumored plant in the western Cornbelt will not be completed until after that — if it is actually built in some unknown location by some as yet unknown company. There is significant risk of a capacity challenge in the fall of 2016! That risk is mitigated by two factors.

First, the Pred 2016 weekly levels in the chart are estimated using THIS YEAR’S very high slaughter levels and the percentage change predicted by Friday’s report. We still think this year’s levels are a bit overblown by efforts to get current/reduce weights. Second, Friday’s report indicated a definite slowing of breeding herd growth. This year’s market has almost certainly cooled some expansion plans, reducing potential ‘16 supplies.