Volatility in Stock Market Could Affect Pork Market

GLOBAL - The slowdown in China and the oil price decline have continued to cause unrest on global stock markets, with some indices, including the FTSE, seeing a 20 per cent drop from 2015 peaks.China’s official growth figure released last week dropped to 6.9 per cent, its lowest for three decades.

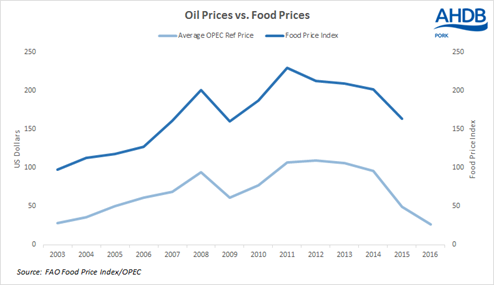

In addition, commodity prices have dropped, with crude oil dipping to $27 a barrel for the first time in nearly 12 years. There has historically been a strong link between oil prices and food prices and we might expect to see the latter fall in the same trend.

It was in China that the stock market instability began and it spread rapidly throughout the world. It has been widely expected that its economy would shift towards services, with less emphasis on manufacturing. Service industries mean more emphasis on Chinese consumers, less on exports and less need for imports of industrial raw materials. However, it has been the speed of this manufacturing slowdown that has concerned investors.

The shift towards a consumer driven economy does signal opportunities for exports to China’s growing middle class. This could provide a long term benefit for pork exporters, as discerning consumers will demand greater quality and choice. However, it may be preceded by a short-term slowdown whilst the economy transitions to new parameters.

Investors are becoming increasingly risk averse in these volatile times, moving towards gold, government bonds and US dollars, fuelled by an increase in US interest rates. This has resulted in a weakening of the pound against both the dollar and the euro, making exports to both areas cheaper but imports more expensive. This is narrowing the gap between EU and UK pig prices, which could eventually support the UK market as products become more price competitive against their EU counterparts.

Last Friday, markets recovered some ground on the suggestion that the European Central Bank will continue Quantitative Easing, along with a rally in the oil price. However, it appears that for 2016, market volatility is becoming the new normal, with the potential for both positive and negative effects on the pig market.