Pork Commentary: June Lean Hog Contracts Reach New High

US - Last Friday, US June lean hog contracts closed at 83.075¢ per pound a life of contract high.Since mid-November June lean hogs have gained 12 or about $25 per head. As a producer it’s great to see. Rising lean hog contracts reflect growing faith in pork demand and we believe the realization that hog market numbers are not growing appreciably. The constant discussion of lack of shackle space has hampered potential price increases. As that discussion indicates there will be price pressure lows.

Last week the US marketed 2,215,000 hogs down 11,000 from a year before. Obviously less hogs per week year over year is not adding pressure on packer shackle space.

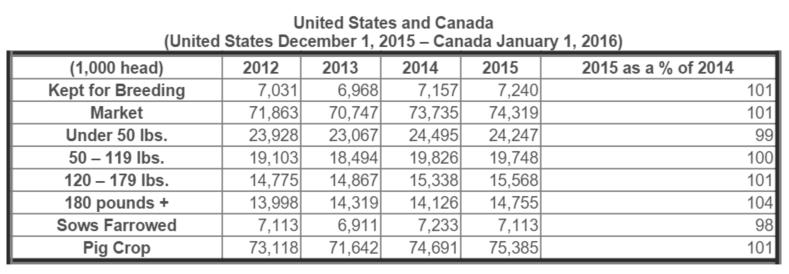

United States and Canada Inventory

The US – Canada Hogs and Pigs Inventory was released last week. It is done twice a year. Since pork flows quite freely between both countries the combined Hogs and Pigs Inventory is important to show what total supply will be. It’s a continental market.

Observations

- Breeding herd is up 1%, an increase but not a huge increase relative to what the myth makers in the industry were predicting.

- Market numbers up 1% - equal to the US population increase. If per capita consumption can hold most if not all extra pork can be domestically consumed.

- Under 50 pounds are down 1% and Sows farrowing are down 2%. Both a reflection of extender issues that hit the US – Canada industry. We can have rebound numbers in the future leading to more supply.

- Pig Crop 75.385 million (6 months). Simple Farmer Arithmetic. 75.385 x 2 = 150.770 (one year) divide by breeding herd 7,240 = 20.82 pigs per breeding herd. Not exactly 30 or even 25. Half of herd will be below 20.82.

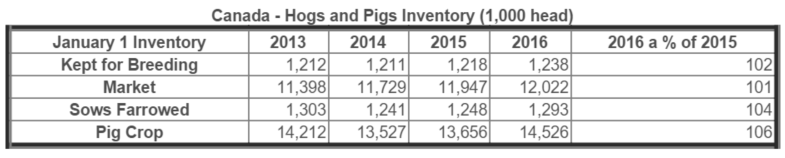

The Canadian Inventory Report as of January 1, 2016 Observations

- Canada has expanded breeding herd 20,000 – it was flat for the previous three years.

- Market number up 1% - In Western Canada there is excess packer capacity. In the East of Canada there is not enough which is leading to more market hogs going to the USA.

- Sows farrowed and Pig Crop are up compared to last year but about equal to 2013.

- Pig Crop 14,526 million – farmer arithmetic 14,526 x 2 = 29,052 million head a year divide by breeding herd 1.238 million = 23.46 pigs per breeding herd. The US – Canada (including Canada) average was 20.82. It appears to us that Canada pigs per breeding herd is almost three pigs better than the US.

Some Thoughts Why:

- We observe Canadian producers are less focused on least cost feed. Feed to maximize performance.

- General health of the Canadian herd is probably better.

- Canada has a higher percentage of sow herds managed by owner operators with good levels of stockmanship.

- Canada has a higher level of F1 gilt usage and less reliance on back cross – mongrel breeding gilts. This leads to higher litter size in Canada relative to the US. Genesus only produces F1 gilts as parents for this very reason. Why would you ever want in a business to use a combination that doesn’t allow maximum productivity?

Summary

June lean hogs hit contract high. We expect it to continue to go up as supply relative to demand will allow higher pork prices. When we look at USA – Canada swine inventories we do not see a significant increase in production. Concerns about shackle space is overblown, especially when you consider the new plants under construction.