Opportunities and Challenges for the Sub-Saharan Africa Meat Market

AFRICA - A new study of Sub-Saharan Africa’s meat supply chain reveals that demand is expected to grow but that many producers may struggle to meet this unless they move to a more commercial base, writes Rupert Claxton, Gira.Of the 43 markets covered in Gira’s Sub-Saharan Africa study all except Chad and Niger had an increase in meat and fish consumption from 2004-2014.

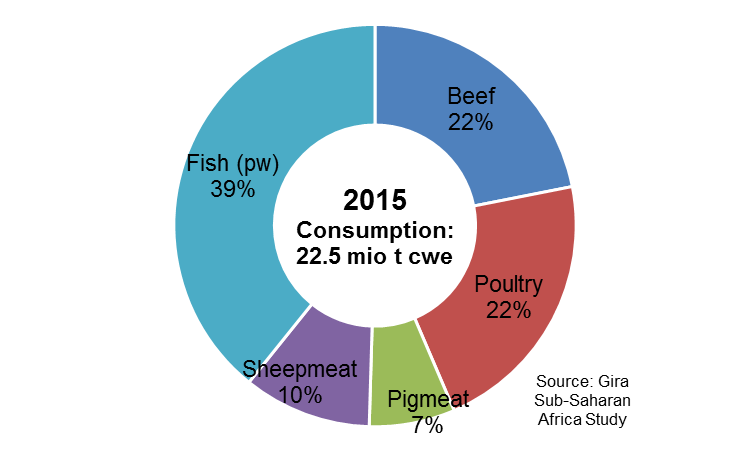

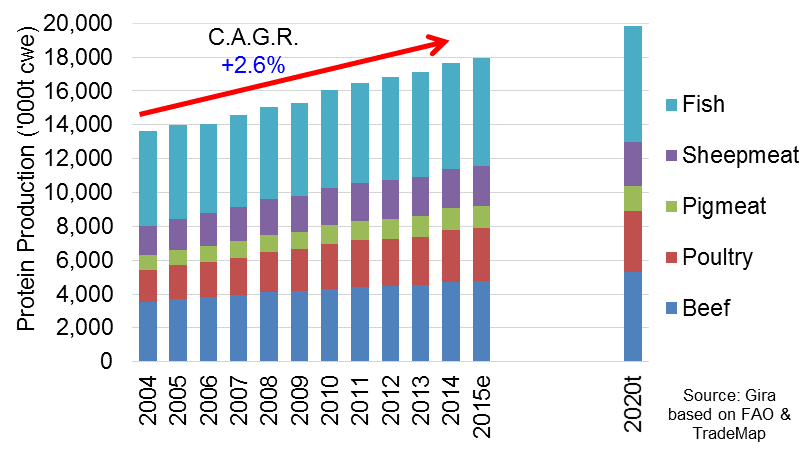

The average for the region was 4% per annum with the total volume reaching 22 million tonnes cwe in 2015, itself a bad year due to global commodity price impact on African economies! Gira’s mid-term outlook suggests growth of over 3%, and this is with the expectation that the local supply structure will struggle to keep abreast of demand.

The Sub-Saharan region has not featured strongly in the minds of exporters or investors from the meat industry historically, with diverse markets, and complex political and social issues, making it a difficult region to operate in. But, the growth seen over the last 10 years, and the expected mid and long term outlook mean that Sub-Sharan markets will become increasingly significant for both.

Most attention from outside (and also from inside) is focussed on the major markets of; South Africa (the most advanced, economically and agriculturally), Angola (the biggest meat importer) and Nigeria (optimistically touted as the up and coming economic power house) … and few companies venture far beyond this.

These markets are the largest meat markets in Africa, with arguably the biggest potential, but the opportunity beyond these is strong, but far less understood.

Sub-Saharan Africa’s population of 975 million consumers is growing at 2.6 per cent per annum, and has been for the last decade.

These consumers are mostly very poor (by international standards) and meat and fish only represents an occasional dietary option, with eggs and fermented milk more common protein sources. But, rising disposable incomes and a growing middle class mean that the population is gaining a taste for increased meat consumption, which combined with a strong population growth rate and rapid urbanisation means that the potential is only just being realised.

But the challenges for the industry in the mid-term will slow the potential growth as livestock production, as in all markets, except South Africa, production remains mainly in the backyard and informal sector.

The current producers can expand, but are limited by their agricultural knowhow, access to funding and desire for more market focused production. This means that to meet the increase in demand for meat the industry must transition to a more commercial base. This is a process that is already underway, but at very different levels in different markets.

There are a handful of integrated meat companies outside of South Africa, most of these are medium or small scale and focused on broiler chicken. The development of commercial slaughter houses requires commercial livestock farmers to feed them in a reliable manor… and this is not something that can be easily done from the backyard.

Where slaughter companies are expanding it is often with a mix of investment in their own farming activity, and by encouraging the best of the local producers to up their game… a difficult but not insurmountable process.

The next challenge is meat preference. In most markets this is beef, sheepmeat or fish, rarely chicken (except again in South Africa and Angola the key chicken consumers), and only in one country is pork the preferred meat. This is in itself a challenge, as the focus for more meat consumption should be on low priced meat that is locally available, and who’s production can develop rapidly.

Increases in chicken consumption will be more rapid than the other meats, at +4.6 per cent p.a. to 2020, challenging cultural preferences for other meats. This is due to the ease of investment in modern broiler production, the relatively quick returns from intensive farming, and the low per kilo price of chicken winning consumers over. There is already a scaling up of the better informal producers in many markets, and the transition of these into fully commercial ventures will be important to the supply of meat, and controlling prices.

Growth in production of beef and sheepmeat will be slower as the current production model is still heavily reliant on the informal and tribal sector, which currently supplies cattle for the commercial sector as well as the local market. Whilst there are several notable and successful efforts to develop commercial cattle production the rate of growth is limited by cattle rearing cycles, and disruption from drought. It is expected that neither beef or sheepmeat production will be able to grow at a rate above the population growth rate, leading to declines in per capita consumption, and intensifying demand for chicken.

Fish is the major contributor of animal based protein in the diet in many countries, and is expected to remain so. But strong investment in commercial aquaculture ventures and rapid increases in production from the sector, must be offset by the fact that farmed fish are only a small share of production, and the more significant wild catch is challenged by overfishing and pollution of inland waters.

Growth in domestic meat production will continue, it will become increasingly commercial, and the opportunity for global agricultural businesses to benefit from either direct investment or as suppliers of inputs is there, but it will happen at different rates in different markets.

In the meantime, import demand is continuing to develop led by the western coast importers, but with emerging opportunities in a wide variety of markets, even those with apparently prohibitive government restrictions. The trade very largely favours low value cuts, and has focused on chicken (leg quarters and MDM) and pig off cuts (feet, masks etc). The role of imports will continue to be as a mechanism to supply low cost protein, and will favour markets with little or no domestic production to be disturbed.

The expectation for the mid-term is that the markets of Sub-Saharan Africa are reaching a tipping point, with production lagging demand, and rising prices, opening the door to measured increases in imports, giving the domestic industry a chance to commercialise production and increase supply. The level of domestic growth will require substantial investments across the region, and these take time in planning, funding and implementation, and Gira would therefore expect to see strong growth beyond 2020 than in the next 5 years.

This comprehensive study by Gira of the dynamics and future of Sub-Saharan Africa’s meat supply chain is the first time anyone has comprehensively analysed and documented the production structures and volumes for beef, pork, and broilers in all the 43 Sub-Saharan markets, covering all the main products and their processing, imports, retail & foodservice, and consumption.

Full copies of the study “Sub-Saharan Africa Meat Market Opportunities” are available for purchase direct from Gira, complete with an Excel database on all 43 markets. For more information, please get in touch with Rupert Claxton: [email protected] or +44 1323 870137