Pork Commentary: Global Market Thoughts!

GLOBAL - It’s the New Year and we are thinking about the China swine markets and how it will affect us, writes Jim Long President – CEO Genesus Inc.China – current price: 17.51 CNY/kg liveweight (U.S. $1.14/ lb liveweight)

China’s producers continue to be in the black, black, black. The market hog price of $1.14 US liveweight lb., is pushing $300 per market hog. Profits, despite China’s lower productivity and higher feed costs, are still over $100 US per head.

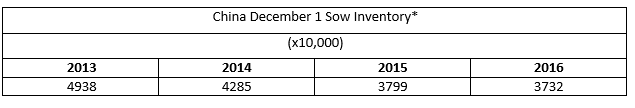

Pork imports to China hit 1.5 million tons in 2016, which was 1.2 times 2015. What is extraordinary is that the China sow inventory has not started to expand despite record profits.

*China Ministry of Agriculture

As you can see, despite profits exceeding $100 per head for over a year, official China Government statistics show no increase in the Chinese sow inventory in the last year.

The Chinese government is estimating 590 million market hogs in 2017. In 2015, China produced 708 million head. An over 100 million head shortfall. This shortfall will obviously support having strong prices in China over the next year while stimulating continued large pork imports from North American and Europe. All producers outside of China have reasons to rejoice, the huge pork exports China will have in 2017 will support every producer price in every country.

Breeding Stock Imports

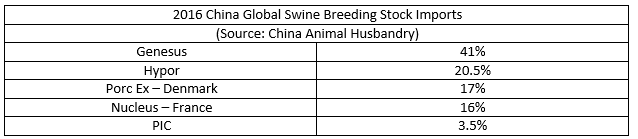

In 2012, the China Market for breeding stock was dominated by the U.S. purebred breeders, with well over 50% of the market. Since then and the huge losses producers in China got hammered with (they dropped 11 million sows) the market has changed. Now, the survivors in China are looking for high producing genetics that live, grow, have big litters, and have tasty meat. Exports from around the world tell the story of the market evolution.

As you can see, Genesus dominates the China import market. Porc Ex has now become a Genesus distributor. As you can observe, there are no imports from the USA purebred industry. In 2012, they were dominant. Today, the pressure to have better genetics after the financial losses in 2013-2014 creates a different story.

Some might ask why China has not expanded in 2016. Our thoughts:

- There were billions of dollars lost by Chinese producers in 2013-2014. 11 million plus sow decreases didn’t happen because people were making money. Indeed, we have seen few producers ever quit anywhere when they were making money. Surviving producers had big losses to cover to get back to where they were.

- Environmental regulation and government policy are making the process of building barns more difficult. This is slowing expansion possibilities.

- Disease challenges are a big issue. Also, human resource skills in modern hog production is in a shortage. Having some sows in the backyard doesn’t qualify you to run a 2500 sow unit. The general insistence that barn personnel have to live at the swine barn sites for weeks at a time without leaving is not conducive to hiring smart people with other career opportunities. It’s hard to believe, but despite 1.4 billion people in China, labour for pig producers is a challenge.

- We believe that China will import significant amounts of pork for a long time. Maybe 5-15% of their production needs. A significant amount.

USA

Holidays are never good for hog producers. The loss of slaughter days gives packers leverage. This year was no different, with Christmas and New Years a week apart.

We expect the next two weeks will get hogs more current. After that, we expect a seasonal decline in hog numbers. With US pork cutouts at $0.80/lb and lean hogs about $0.55/lb, the $0.25/lb spread is great incentive for packers to kill, kill, kill. They will and they will make money. We expect though as seasonal decline in hog numbers come through, packer margin will narrow, lean hogs in the 60s soon is very doable.