Reduced available supplies pushes EU pork prices up - AHDB

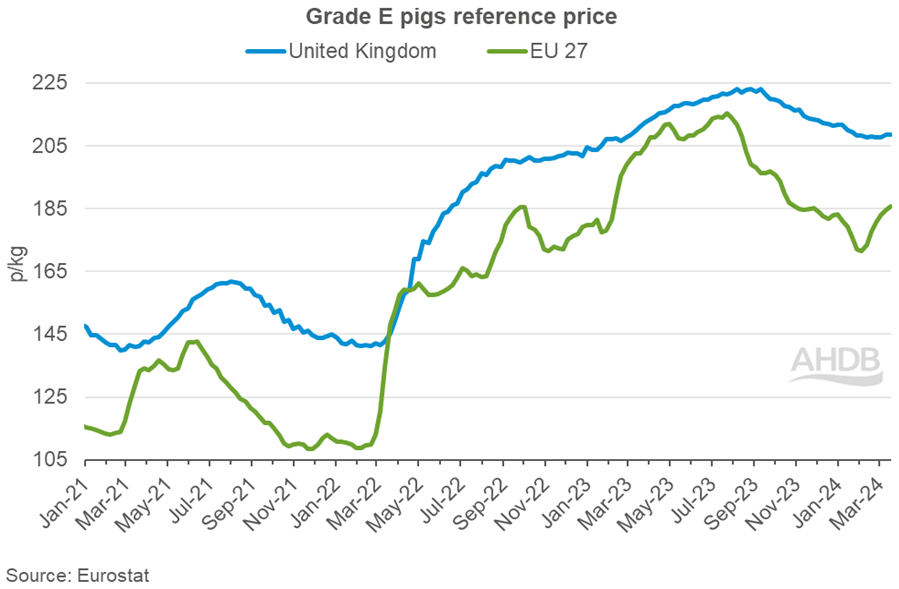

Pig prices in Europe pick up following six months of declineEuropean pig prices have seen some significant movements in the first 11 weeks of the year, according to AHDB market analyst Freya Shuttleworth.

In the first five weeks (period ending 4 Feb), prices dropped off sharply, losing on average 12p/kg, on the back of seasonally weak demand. However, in the latest six weeks (period ending 17 Mar), prices have recovered, gaining 14p to average 185.63p/kg. All key producing nations have recorded strong growth in recent weeks on the back of tightening supplies.

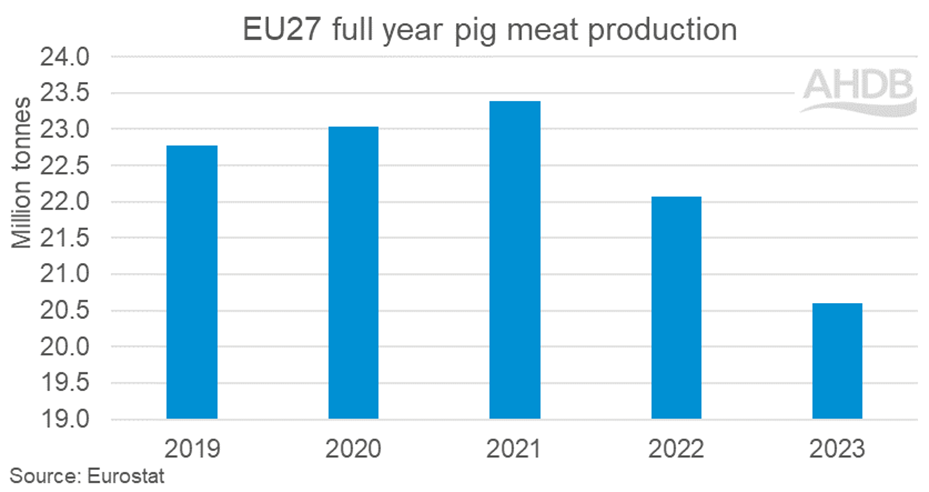

The driving force behind these price increases has been reported as an uplift in demand alongside the continued tightening of supply. Production of pig meat in the EU was the lowest volume recorded in over a decade in 2023, at 20.6 million tonnes. This is a 7% decline year-on-year and follows a 6% fall in volumes in 2022. These declines have been driven by reduced slaughter numbers, which are also back 7% year-on-year.

Forecasts for 2024 predict further decline in pig meat production, with the contraction in herd size seen over the last couple of years not expected to recover. In December 2023 the total pig population in the EU 27 stood at 133.6 million head, the smallest-recorded population since records started in 2001. Pair this alongside incoming environmental regulations and the long-term production outlook for the EU appears limited, with the EU commission forecasting an annual decline of around 1% between now and 2035.

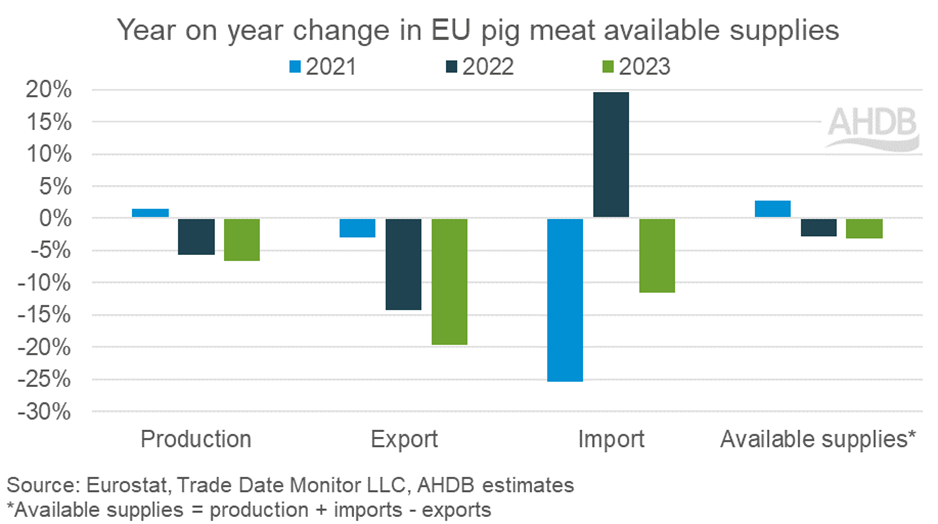

A challenging trade dynamic through 2023 may also have had some part to play in tightening pig meat supplies. EU exports of pig meat (including offal) saw significant year-on-year decline, standing at their lowest-recorded volume since 2014, at 3.90 million tonnes. Much of this decline can be attributed to production losses, although some product may have lost out on key destinations due to increased global competition. However, this would not have been enough volume to outweigh the changes in production and imports.

EU pig meat imports (including offal) totalled 146,800 tonnes in 2023, the lowest volume recorded in over a decade (excluding 2021 due to initial Brexit trade friction). Despite the EU commission forecasting per capita consumption to fall 5% in 2023 as the increased cost of living impacted consumer spending, this volume drop in supplies available will have caused disruption to the market, raising prices paid.

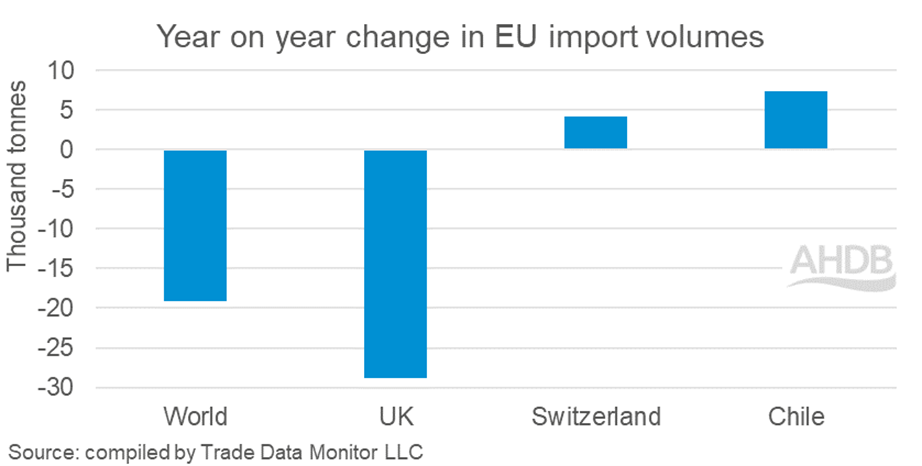

An impact to the UK of these changing market dynamics has been a reduced market share in EU import volumes. Historically, between 80 and 85% of EU pigmeat imports were sourced from the UK; however, in 2023 it was sitting at 71%. Although the reduced shipments from the UK are mainly down to falling domestic supply, high pricing has not aided competition on the global market. Meanwhile import volumes from Switzerland and Chile to the EU grew year-on-year, increasing their market share from 7% and 2%, respectively, in 2022 to 11% and 8% in 2023, respectively.