New economic study: African swine fever outbreak in the US could cost $50 billion

Economists study two scenarios indicating the economic impact of ASF in the US.Export sales of US pork reached an all-time high in 2019 of $6.95 billion mt (5.89 billion pounds)1, with exports accounting for 26.9 percent of the market. The export market returns an average $53.51 per head back to US pork producers.

“Pork production in the US exceeds domestic consumption by 25 to 30 percent, so it’s important to have export markets open as they are imperative to the vitality of the American pig farmer,” said Dr Dermot Hayes, Iowa State University agricultural economist and one of the authors of the study.

Study design

The study2 established a baseline scenario which represents the status quo (where no ASF disease exists). Two scenarios are compared to the baseline to estimate the impact of industry downsizing on the US economy.

- Two-year scenario – assumes the US quickly gets the disease under control and reenters export markets within two years.

- All-years scenario – assumes the disease spreads to feral swine and the US is unable to eliminate the disease over the 10-year projection period; and exports never resume.

Key impacts

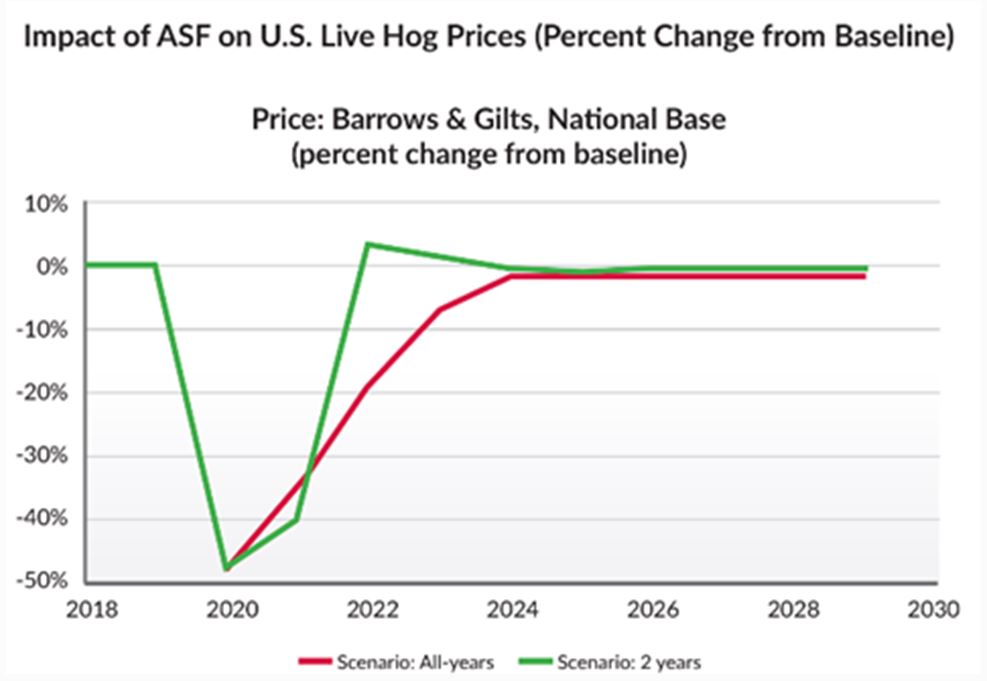

If ASF were identified in the US, export markets would immediately close to US pork, including ASF-positive countries such as China and the Philippines, which prohibit the importation of pork from any country with the ASF virus. US live hog prices would drop by 40 to 50 percent to sell the surplus of pork intended for export. The oversupply of pork in the domestic market would lead to price reductions of other proteins. Lower demand for grain would reduce feed prices.

The long-term impacts are dependent on the scenario:

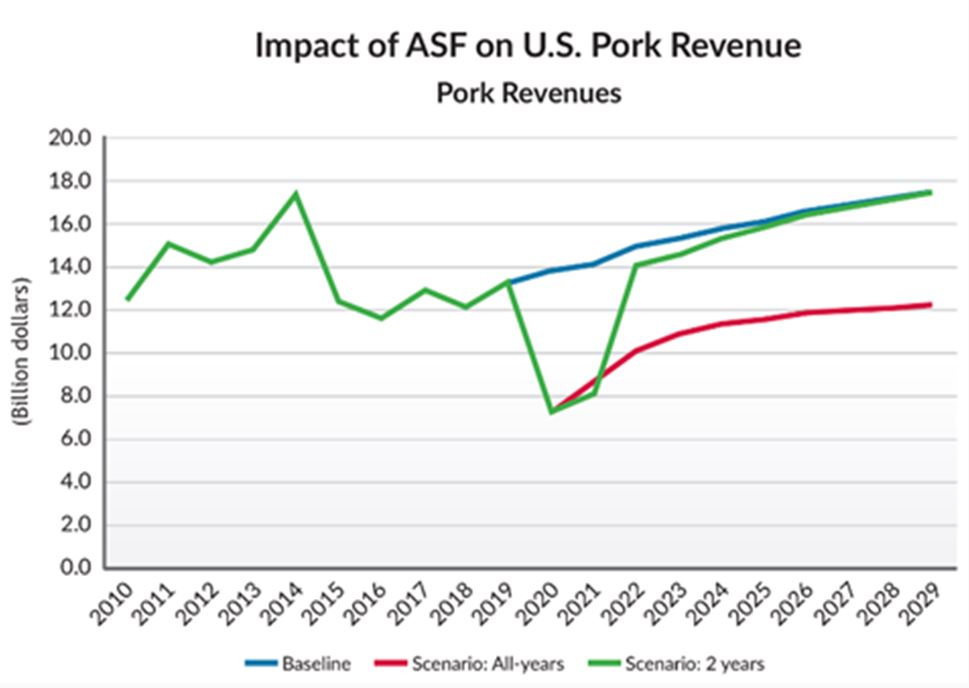

- Revenue losses – lower prices and quantities sold would lead to a decline in pork industry revenues.

- Two-year scenario – $15 billion in losses.

- All-years scenario – $50 billion in losses.

- Employment

- Two-year scenario – minimal job losses at the end of 10 years.

- All-years scenario – 140,000 job losses at the end of 10 years; 22,000 lost jobs in Iowa.

- Swine industry downsizing

- Two-year scenario – exports resume before downsizing occurs.

- All-years scenario – industry reduction after about five years and remains at a lower output.

“Ensuring a two-year scenario versus the all-years scenario means a $35 billion difference to the industry because we avoid downsizing,” said Dr Hayes.

Study results

- All-years scenario – prices fall by about 47 percent in Year 1, but stabilise at 1.8 percent lower than the baseline due to lack of pork exports.

- Two-year scenario – prices decline by 47 percent, but regain baseline levels as soon as pork exports begin to recover.

- All-years scenario – drops well below the baseline and never recovers.

- Two-year scenario – initial drop, but recovers to baseline levels in the last three years of the projection period.

Implication for the pork industry

The study results indicate the costs associated with an ASF outbreak in the US are significant and require risk mitigation and safeguards to protect against importing the disease.

“Movement data will be needed for people, pigs, vehicles, equipment and feed for each site within your operation,” said Dr Howard Hill, DVM, PhD. “The data will need to be shared quickly with state and federal animal health officials, your veterinarian, as well as neighbouring producers to help each other contain the disease.”

Having immediate access to electronic data for all types of pig movement is a crucial step to stopping the spread of ASF. This information will be required to prove negative status of farms, so the industry can maintain business continuity.

“Keep in mind that at any point in time, we have more than one million pigs on the road being transported in the United States. We need a method to quickly identify infected pigs and the pigs that have been in contact with infected pigs, so they can be euthanized. This would allow the industry to regain export markets before downsizing occurs, thus saving billions in losses,” said Dr Hill.

For more information or to read the full study, go to ASFImpact.com.

The study was funded by Iowa State University and BarnTools, a digital biosecurity platform company; and is an update to “Economy Wide Impacts of a Foreign Animal Disease in the United States” published in 2011 and funded by the National Pork Board.

| References | ||||

|---|---|---|---|---|

| (2020) | US Pork Exports Set Both Value and Volume Records in 2019. | |||

| Carriquiry, M., Elobeid, A., Swenson, D., and Hayes, D. | ||||

| (2020) | National and Iowa Impacts of African Swine Fever in the United States. |