Pig outlook: Lean hog futures bulls in command

Livestock analyst Jim Wyckoff reports on global pig news

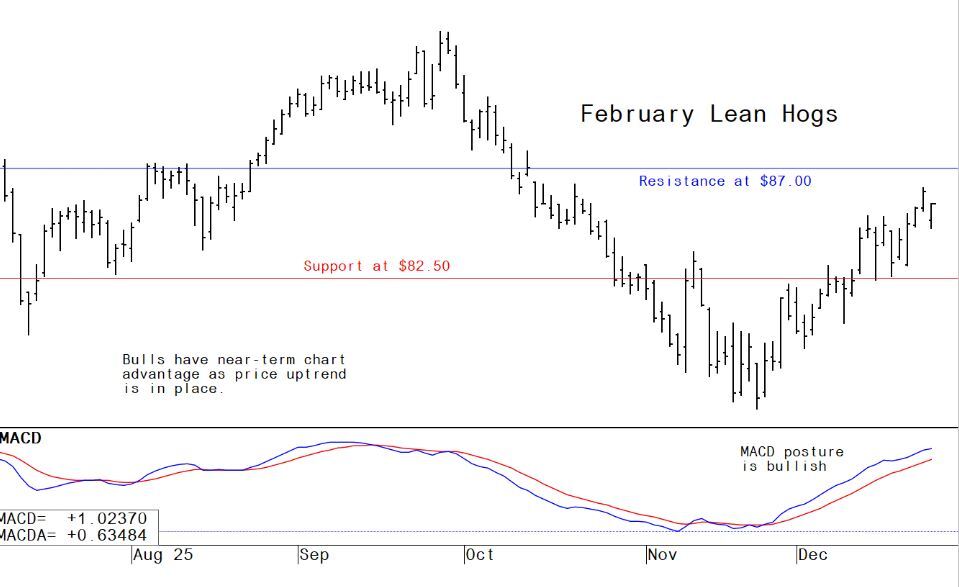

February hog futures climbed to their strongest level in two months on technical buying and firm cash signals, even as USDA’s quarterly hogs and pigs report pointed to slightly larger supplies ahead. Lean hog futures pushed to a two-month high Tuesday. February lean hog futures on Tuesday rose 60 cents to $85.95, nearer the session high and hit a two-month high. Hog futures saw more technical buying from the speculative traders. Bulls have momentum on their side, to suggest more upside. Recently rising cash hog prices and a bullish near-term chart posture for the futures market will continue to support buying interest in lean hog futures. The February futures contract is above the latest CME lean hog index, which is also bullish for futures. The latest CME lean hog index is down 2 cents to $83.71. Today’s projected cash index price is up 1 cent at $83.72. Tuesday’s national direct 5-day rolling average cash hog price quote is $69.41.

USDA quarterly hogs and pigs report leans bearish

USDA Tuesday afternoon reported the US inventory of all hogs and pigs on December 1 was 75.5 million head--up 1 percent from December 1, 2024, and up slightly from September 1, 2025. Breeding inventory, at 5.95 million head, was down 1 percent from last year, but up slightly from the previous quarter. Market hog inventory, at 69.6 million head, was up 1 percent from last year, and up slightly from last quarter. The September-November 2025 pig crop, at 35.0 million head, was up slightly from 2024. Sows farrowing during this period totaled 2.93 million head, up slightly from 2024.

The sows farrowed during this quarter represented 49 percent of the breeding herd. The average pigs saved per litter was 11.93 for the September-November period, compared to 11.92 last year. Hog producers intend to have 2.89 million sows farrow during the December 2025-February 2026 quarter, up 2 percent from the actual farrowings during the same period one year earlier, but down 1 percent from the same period two years earlier. Intended farrowings for March-May 2026, at 2.91 million sows, are up 2 percent from the same period one year earlier, but down slightly from the same period two years earlier. The total number of hogs under contract owned by operations with over 5,000 head, but raised by contractees, accounted for 52 percent of the total United States hog inventory, up 2 percent from the previous year.

“This is the smallest US Dec 1 breeding herd since 2014,” economist Lee Schulz said during a webinar hosted by the National Pork Board and as reported by Farm Journal’s Pork Daily. “Farrowing intentions are also above year-ago levels at 2.89 million sows for the December 2025 through February 2026 quarter. The outlook is favorable so the incentive is there to farrow more sows, but there is a limit given the size of the breeding herd.” The breeding inventory was in line with pre-report expectations, Schulz said. However, some believed the breeding herd could have seen some modest expansion and been larger than a year ago.

USDA reports on livestock imports

USDA reports Import-side shifts: livestock and beef stand out.

- Livestock, dairy, and poultry imports are forecast at $31.7 billion, higher than August but slightly below FY 2025.

- Beef and veal imports are projected at $13.9 billion, up from August and above FY 2025 levels, reflecting continued reliance on foreign supply.

- Cattle and calf imports rise modestly from August but remain well below FY 2025.

Imports from Brazil are forecast to rebound to $7.8 billion, though still short of FY 2025 levels, while Argentina is seen steady near $2 billion.

Brazil antitrust watchdog eyes US meatpacker probe as Trump DOJ investigation expands

CADE seeks clarity from US authorities amid allegations that foreign-owned processors may be manipulating beef prices, raising cross-border competition concerns

Brazil’s antitrust authority, the Administrative Council for Economic Defense (CADE), is preparing to contact the US Department of Justice to determine the scope of an American investigation into potential anticompetitive conduct by meatpackers operating in the United States.

The move follows a formal request from Izalci Lucas, who urged CADE to examine whether alleged cartel behavior abroad could harm Brazil’s economy. According to sources cited by Valor, CADE’s General Superintendence will first seek details from US authorities before deciding whether to open its own inquiry.

In his letter, Lucas said Donald Trump directed the Justice Department to investigate foreign-owned meat processors for possible cartelization, price-fixing, and price manipulation. Trump has argued it is suspicious that US cattle prices have fallen while beef prices remain elevated.

Industry groups dispute that claim. The Meat Institute, which represents more than 350 companies, said meatpackers have been operating at losses for over a year and that transactions are transparent. It argues that despite high retail beef prices, producers are squeezed by record cattle costs — a situation expected to persist into 2026.

Brazilian firms feature prominently in the US protein market. JBS is the largest meat producer in the United States, while National Beef — owned by Marfrig — is the fourth largest and among the most profitable. Lucas also cited CADE’s 2024 approval of Minerva’s acquisition of Marfrig assets, which came with conditions reflecting competition concerns, including adjustments to non-compete clauses and required divestments.

Of note: Legal experts note that while a request from a lawmaker carries weight, Brazil’s competition law fast-tracks only submissions from congressional committees into formal administrative inquiries. Still, the episode revives a familiar theme: the meat sector has faced congressional scrutiny before, notably in 2005, when complaints led to one of CADE’s earliest cease-and-desist agreements.

For now, CADE’s next step hinges on what the Justice Department reveals about the US probe — and whether alleged conduct abroad warrants parallel action at home.

The next week’s likely high-low price trading ranges:

February lean hog futures--$84.00 to $87.00 and with a sideways-higher bias

January soybean meal futures--$297.00 to $310.00, and with a sideways-higher bias

March corn futures--$4.40 to $4.57 and a sideways-higher bias

Latest analytical daily charts lean hog, soybean meal and corn futures