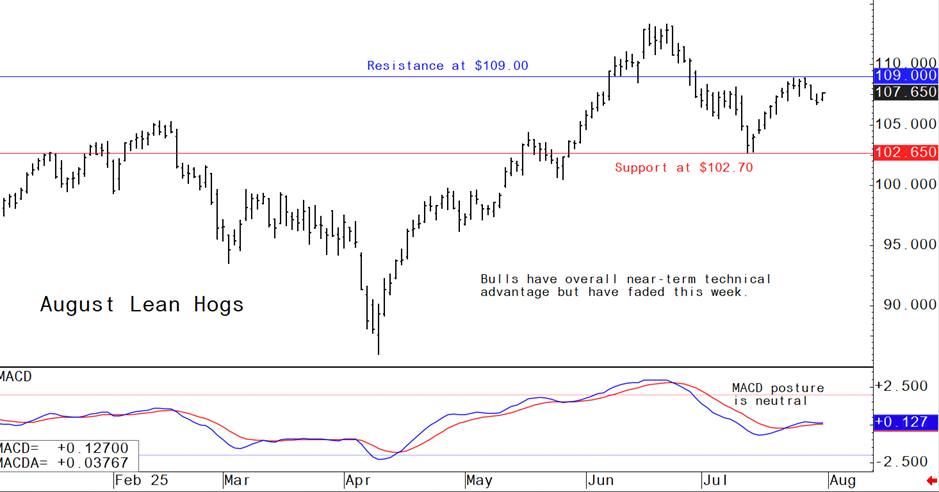

Pig outlook: Lean hog futures bulls losing steam

Jim Wyckoff reports on global pig newsThe lean hog futures bulls were working to stabilize the market following late this week, after early-week selling pressure. Near-term technicals have deteriorated, with fresh pork market fundamentals also weakening. The latest CME lean hog index is up another 13 cents to $110.45 as of July 28. Thursday’s cash index projected price quote is up 6 cents at $110.51.The national direct five-day rolling average cash hog price quote today is $113.03.

Latest USDA and other news regarding the global pork industry

Weekly USDA export sales for US pork

Pork: Net sales of 39,500 MT for 2025 were up noticeably from the previous week and up 85 percent from the prior 4-week average. Increases were primarily for Mexico (23,100 MT, including decreases of 600 MT), Japan (8,100 MT, including decreases of 100 MT), South Korea (3,300 MT, including decreases of 100 MT), Colombia (900 MT, including decreases of 100 MT), and Honduras (900 MT). Total net sales of 100 MT for 2026 were for Japan. Exports of 26,800 MT were down 3 percent from the previous week and 6 percent from the prior 4-week average. The destinations were primarily to Mexico (11,600 MT), Japan (3,200 MT), South Korea (2,800 MT), China (2,700 MT), and Colombia (1,600 MT).

USDA releases first forecasts for 2026 food price inflation

2025 Outlook Mostly Steady, But Beef and Eggs See Notable Revisions

For 2025, USDA left most projections unchanged from June. All food prices are still forecast to rise 2.9%, and grocery prices 2.2%. However, the agency raised its restaurant price forecast to 4.0%, up from 3.7% previously.

Prices for the “other foods” category, which carries a 12.8% weight in the CPI food index, are expected to rise 2.9% in 2026, accelerating from the 1.6% rise forecast for 2025. The 20-year average for this category is a 2.4% increase.

While 2026 forecasts show promise for easing food inflation, USDA cautions that conditions remain fluid. Food prices — particularly for items like eggs and beef — remain sensitive to supply shocks and market volatility. USDA’s forecasts have already shifted significantly over the past year, and further revisions are likely as new data emerge.

The next week’s likely high-low price trading ranges:

August lean hog futures--$105.00 to $110.00 and with a sideways-lower bias

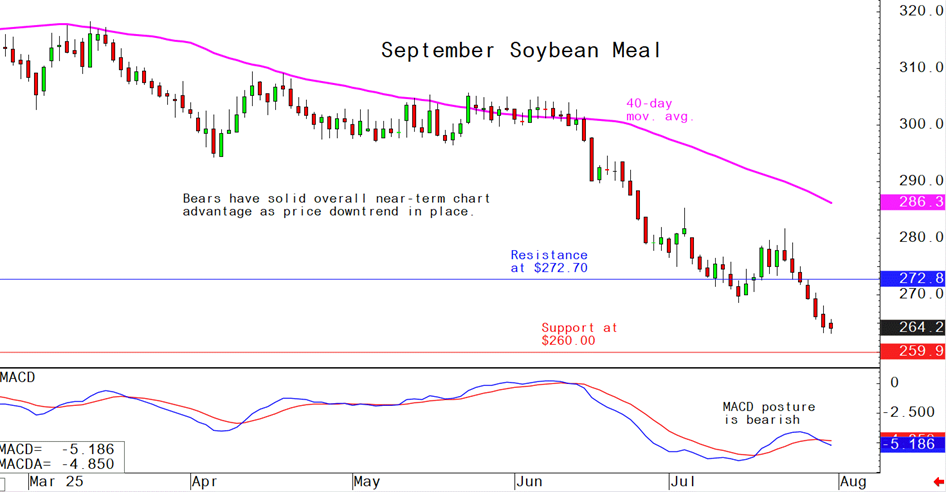

September soybean meal futures--$250.00 to $275.00, and with a sideways bias

December corn futures--$4.00 to $4.20 and a sideways bias

Latest analytical daily charts lean hog, soybean meal and corn futures