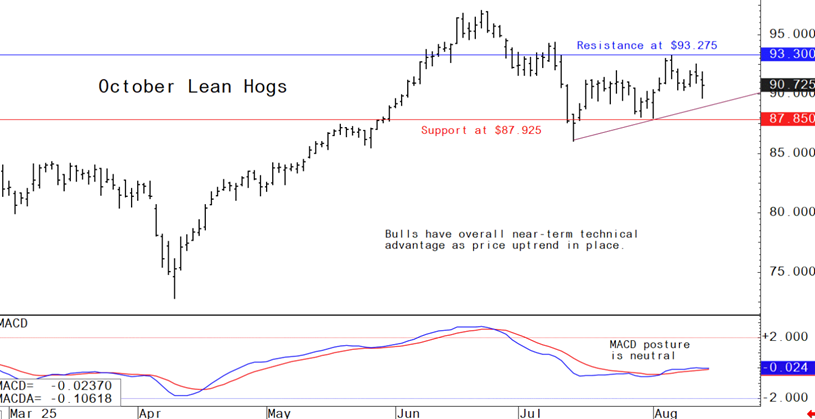

Pig outlook: Lean hog futures bulls keeping price uptrend alive

Livestock analyst Jim Wyckoff reports on global pig newsThe lean hog futures market Wednesday saw some profit-taking pressure amid fading cash fundamentals and a solid decline in pork cutout value this week. The latest CME lean hog index is down 23 cents to $110.02 as of Aug. 8. Thursday’s projected cash price is down 6 cents to $109.78. The national direct five-day rolling average cash hog price quote Wednesday was $108.99. The lean hog futures bulls are keeping alive a price uptrend on the daily chart for August futures. However, bulls need to show fresh power soon.

Weekly US pork export sales report

Pork: Net sales of 21,200 MT for 2025 were down 32 percent from the previous week and 19 percent from the prior 4-week average. Increases primarily for Japan (6,500 MT, including decreases of 100 MT), Mexico (4,700 MT, including decreases of 600 MT), South Korea (3,500 MT, including decreases of 100 MT), Colombia (1,700 MT, including 100 MT switched from Guatemala and decreases of 100 MT), and Honduras (1,200 MT), were offset by reductions for Hong Kong (100 MT). Exports of 27,000 MT were down 4 percent from the previous week and 1 percent from the prior 4-week average. The destinations were primarily to Mexico (13,200 MT), Japan (3,500 MT), South Korea (2,300 MT), China (2,200 MT), and Colombia (1,400 MT).

USDA Monthly livestock report

LIVESTOCK, POULTRY, AND DAIRY: The forecast for 2025 red meat and poultry production is reduced from last month. Beef production is lowered on reduced fed and non-fed cattle slaughter and lighter dressed weights. Pork production is reduced reflecting official data reported through the first half of the year, as well as a slower slaughter rate and reduced dressed weights in the third and fourth quarters.

The pork export forecast for 2025 is raised based on official data reported through June and no changes are made to 2026 pork exports. The broiler export forecast is also raised for 2025 based on data through June and is unchanged for 2026. The turkey export forecast for 2025 is raised on data through June and higher exports for the third quarter. The 2026 turkey export forecast is unchanged. Cattle price forecasts for 2025 are raised for both the third and fourth quarters based on recent price strength and resilient demand for beef. The higher cattle price forecasts are carried into 2026.

The 2025 hog price forecast is raised based on recent prices, with increases continuing into 2026 on tighter pork supplies. Broiler price forecasts for 2025 are reduced for the second half of the year based on recent price declines through early August, with reduced prices carrying into next year.

Smithfield boosts 2025 profit outlook on strong meat demand

Smithfield Foods posted quarterly sales of $3.79 billion for the period ended June 29, an 11% increase from a year earlier. Adjusted earnings rose to 55 cents per share from 51 cents last year. The company now expects 2025 adjusted operating profits between $1.15 billion and $1.35 billion, up from its prior forecast of $1.10 billion to $1.30 billion. In the second quarter, packaged meat sales climbed 6.9%, while fresh pork sales advanced 5%. Smithfield attributed the gains to robust demand for products such as bacon and fresh pork cuts, with more consumers choosing to dine at home.

US Court upholds EPA livestock emissions exemption

Judge says 2018 law supports agency’s decision not to require disclosure

The US District Court for the District of Columbia on Aug. 7 upheld an EPA rule exempting livestock operations from reporting toxic air emissions, finding it aligned with congressional intent under the 2018 Fair Agricultural Reporting Method Act. Judge Timothy Kelly said the rule was a “straightforward reading” of the law and consistent with decades of interpretation under CERCLA and EPCRA.

What’s next: Environmental groups, which argued the exemption violated EPCRA by shielding ammonia and hydrogen sulfide emissions from disclosure, have not yet decided whether to appeal.

Beyond Meat misses Q2 targets

Plant-based meat maker cites weak U.S. demand and global uncertainty

Beyond Meat reported second quarter net revenues of $75 million, down 19.6% from a year ago and well below Wall Street expectations. Gross profit dropped to $8.6 million (11.5% margin), compared to $13.7 million (14.7%) in Q2 2024. The company blamed soft U.S. retail demand, weak international foodservice sales, and losses from exiting its China operations. “We are disappointed with our second quarter results,” said CEO Ethan Brown, attributing the miss to ongoing softness in the plant-based meat category. Elevated consumer price sensitivity continues to weigh on alternative protein sales.

China moves to cut pig numbers amid glut

Industry to curb overcapacity and stabilize hog prices

China’s hog industry will meet in Beijing next week to discuss cutting breeding sow numbers by 1 million, according to a notice seen by Reuters and first reported by Bloomberg. With the national sow herd at 40.43 million — well above the optimal 39 million — the move aims to ease oversupply and stabilize cash hog prices, which have dropped to below 14 yuan/kg from around 20 yuan a year ago. The meeting will also target speculative "secondary fattening" practices and enforce stricter slaughter weight controls.

U.S. meat export snapshot – June 2025

Pork rebounds sharply; China lockout drags down beef shipments

U.S. pork exports surged in June, helping offset earlier-year losses and ending the first half of 2025 on a strong note, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). However, beef exports slumped to their lowest level in five years, largely due to China’s failure to renew most U.S. plant registrations. Lamb exports posted gains from 2024 but saw their weakest monthly performance of the year.

Pork Exports Rebound

- June total: 239,304 mt (+7% YoY) valued at $682.6M (+3.5% YoY)

- Top market: Mexico — $250M (second highest on record)

- Growth areas: Central America, Colombia, Caribbean, Vietnam

- Variety meats: +10% YoY, boosted by shipments to China

- H1 2025: 1.46M mt (–4% YoY); $4.11B (–3.5% YoY; 3rd highest on record)

“We anticipated a June rebound for pork,” said USMEF CEO Dan Halstrom, citing eased trade tensions with China.

The next week’s likely high-low price trading ranges:

October lean hog futures--$87.825 to $93.275 and with a sideways-higher bias

September soybean meal futures--$280.00 to $300.00, and with a sideways-higher bias

December corn futures--$3.85 to $4.11 and a sideways-lower bias

Latest analytical daily charts lean hog, soybean meal and corn futures