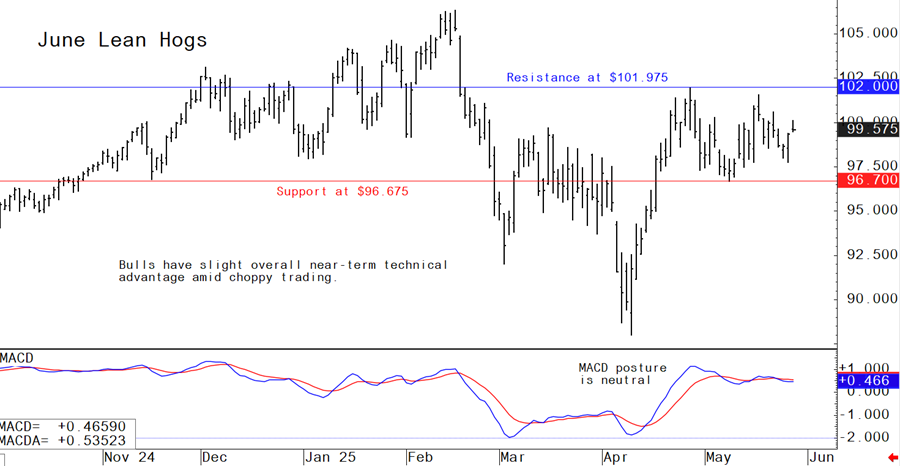

Pig outlook: Lean hog futures trading turns choppy, sideways

Livestock analyst Jim Wyckoff reports on global pig newsJune lean hog futures price action has been sideways and choppy for the past month. Improving cash hog and pork market fundamentals have kept a floor under prices. The latest CME lean hog index is up another 11 cents to $93.05 as of May 23, extending the seasonal rally. Pork cutout also firmed $2.27 to $103.73 on Tuesday, led rise in primal bellies to the highest level since last November. Look for more sideways and choppy trading in the near term, with lean hog futures taking some daily price direction from the cattle futures markets.

Latest USDA and other news regarding the global pork industry

USDA Secretary Rollins sends $14.5 mil. to states for meat, poultry inspection — with a warning

USDA boosts state inspection programs amid funding concerns

USDA Secretary Brooke Rollins announced her department will distribute $14.5 million in reimbursements to state-run meat and poultry inspection programs. This move aims to bolster food safety and ensure that Americans continue to have access to safe, affordable meat and poultry products.

Rollins emphasized the Trump administration’s commitment to supporting the nation’s food supply chain, stating, “President Trump is committed to ensuring Americans have access to a safe, affordable food supply. Today, I exercised my authority to robustly fund state meat and poultry inspection programs to ensure states can continue to partner with USDA to deliver effective and efficient food safety inspection.”

She contrasted this action with previous years, saying, “While the Biden administration let this funding decline in recent years, the Trump administration recognizes the importance of our federal-state partnerships and will ensure services that our meat and poultry processors and producers rely on will continue to operate on a normal basis. The president’s commitment is reflected in his 2026 budget proposal, which calls on Congress to address this funding shortfall moving forward.”

USDA stresses importance — but warns of unsustainable path. USDA explained the critical nature of these funds, noting, “Without this funding, states may not have the resources to continue their own inspection programs which ensure products are safe. This funding increase ensures American produced meat and poultry can make it to market and onto the tables of families across the country.”

However, USDA also issued a warning: “This is not a sustainable path forward. Policymakers across the federal government should come together to think through ways to continue these critical state meat and poultry inspection programs.” This statement highlights the need for a long-term, bipartisan solution to secure ongoing support for state inspection efforts.

State agriculture officials expressed appreciation for the funding in a USDA news release, underscoring the importance of federal-state collaboration in maintaining a safe and reliable food supply.

Bottom Line: While the immediate funding boost will help states maintain vital inspection services, USDA and Secretary Rollins are calling on Congress and policymakers to find a lasting solution for the future of state meat and poultry inspection programs.

Mildly negative USDA Cold Storage data

USDA estimated US pork stocks totaled 455.8 million lbs., up 46.3 million lbs. from March. That was more than double the five-year average increase of 21.7 million lbs., though some of that was due to a 12.8-million-lb. downward revision to March stocks. Still, pork stocks declined 43.5 million lbs. (8.7%) from April 2024 and 92.5 million lbs. (16.9%) from the five-year average.

USDA lowers 2025 food price forecasts

Broader trends and takeaways

- Six food categories are now expected to post year-over-year price declines, including pork and fresh vegetables.

- Eggs, beef, and sugar remain inflation hotspots.

- Eggs: Still volatile, but 2025 increase now forecast at +39.2%, down from +54.6% last month. Prices fell 10.5% from March to April but remain nearly 50% higher YoY, due to HPAI-related supply issues.

- Pork: Now forecast to decline 0.2%, versus a 1.8% increase in April, as production rises.

- Beef & veal: Revised upward to +6.6%, driven by tight supply and strong demand.

- Fats & oils: Shifted to a 1.8% decline, down from a modest 0.2% increase.

- Fruits & vegetables: Overall prices to fall 0.7%; fresh vegetables down 2.9%, fresh fruits up 1.3%.

- Nonalcoholic beverages: Unchanged at +4.2%.

- Other foods: Flat at +1.8%.

- Perspective: Despite lower grocery price forecasts, consumers will still pay more for food in 2025 than in 2024.

- Of note: Food expenditures make up 13.7% of the Consumer Price Index, with eggs accounting for just 1.5% of total food spending.

Bottom Line: USDA’s revised outlook reflects improving supply conditions and easing inflationary pressures — but persistent volatility in select categories like eggs underscores ongoing market uncertainties.

Supreme Court weighs new challenge to California’s Proposition 12

Justice Kavanaugh’s prior dissent offers road map for future legal strategies

Last week the U.S. Supreme Court was actively considering whether to rehear a legal challenge to California’s Proposition 12, the state law that bars the sale of pork from animals not raised under strict welfare standards. The latest petition, Iowa Pork Producers Association v. Bonta, asserts that Proposition 12 unlawfully discriminates against out-of-state pork producers and violates the dormant Commerce Clause. The case has been relisted for discussion at an upcoming Supreme Court conference, signaling heightened interest among the justices.

The American Farm Bureau Federation and NPPC lost their prior Supreme Court challenge to California’s Proposition 12 because the Court found the law was not protectionist, did not impose a substantial burden on interstate commerce, and that resolving such policy disputes is the responsibility of Congress, not the judiciary. The justices made clear that if agricultural interests seek relief, they should pursue a legislative solution rather than further litigation.

Justice Brett Kavanaugh did offer suggestions — effectively a "road map" — for how future challenges to California's Proposition 12 or similar state laws might succeed where the American Farm Bureau Federation and NPPC failed. In his concurring in part and dissenting in part opinion, Justice Kavanaugh highlighted several alternative constitutional grounds that were not fully developed or argued by the plaintiffs in this case. He wrote that while the Court rejected the dormant Commerce Clause challenge as insufficiently pled, state laws like Proposition 12 could also raise "substantial constitutional questions under the Import-Export Clause, the Privileges and Immunities Clause, and the Full Faith and Credit Clause" in future litigation. Kavanaugh noted that he was not expressing a view on whether such arguments would ultimately prevail, but emphasized that these issues "warrant further analysis in a future case".

Kavanaugh also pointed out that a properly pled dormant Commerce Clause challenge under the Pike v. Bruce Church balancing test could potentially succeed, or at least survive a motion to dismiss, if plaintiffs presented more detailed and compelling allegations of substantial burdens on interstate commerce. He specifically criticized the economic impact of Proposition 12, noting that California's large market share makes it "economically infeasible for many pig farmers and pork producers to exit the California market," which in his view could amount to a significant burden on interstate commerce.

In summary, Justice Kavanaugh suggested that future litigants could:

- Present more robust factual allegations to meet the "substantial burden" requirement under the dormant Commerce Clause.

- Explore alternative constitutional arguments under the Import-Export Clause, the Privileges and Immunities Clause, and the Full Faith and Credit Clause.

- Consider the broader implications for federalism and interstate commerce, potentially prompting congressional action.

Of note: On the legislative front, at least one bill — the Ending Agricultural Trade Suppression (EATS) Act — was introduced in Congress as a potential solution, and on the Prop 12 issue there was language in the House farm bill version that would have addressed it.

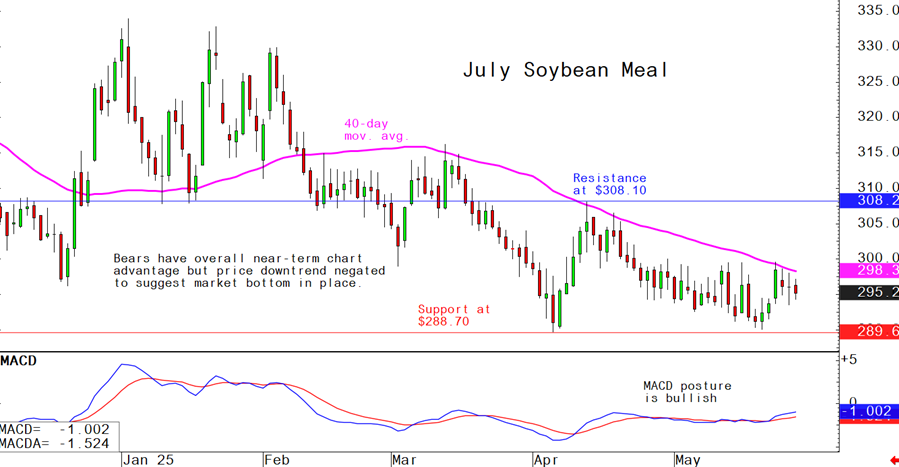

The next week’s likely high-low price trading ranges:

June lean hog futures--$97.75 to $101.975 and with a sideways bias

July soybean meal futures--$289.70 to $308.10, and with a sideways bias

July corn futures--$4.50 to $4.70 and a sideways bias

Latest analytical daily charts lean hog, soybean meal and corn futures