What's the gap between gilts and barrows costing your operation?

New university research review identifies The Gilt GapIt’s well-known that gilt performance is poorer than barrows. Since market pig production is made up of about 50% gilts, it’s important to understand what causes the performance differences and what the gilt gap is costing the industry.

Dr. Ben Bohrer, a meat scientist at The Ohio State University, and Dr. Jason Woodworth, a nutritionist at Kansas State University, recently completed a review of available literature looking at the differences between barrows and gilts in growth performance, carcass composition and meat quality and how to quantify the value of those differences economically.

The research review included a statistical analysis of the combined results of 34 peer-reviewed scientific studies representing almost 16,000 pigs.

“Most individuals involved in the swine industry recognize and appreciate that there are production differences that occur between barrows and gilts,” said Dr. Woodworth. “Our review confirmed that a clearly defined performance gap exists between gilts and barrows.”

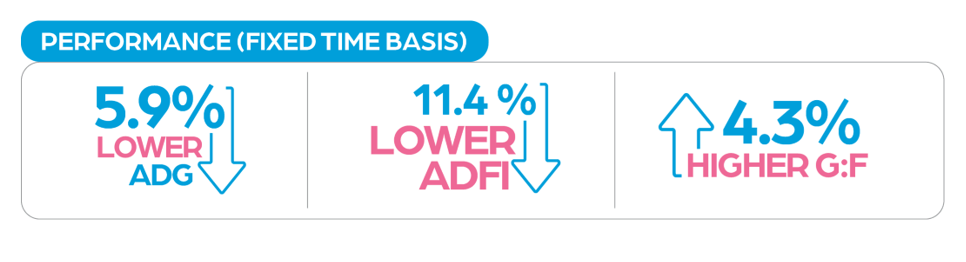

From a live performance standpoint, the study showed gilts were associated with 5.9% lower average daily gain, 11.4% lower average daily feed intake and 4.3% better feed efficiency rate compared with barrows.

“While feed efficiency is improved in gilts compared to barrows, the lower feed intake drives the lost growth performance,” noted Dr. Woodworth.

Loss to estrus development – the cause of the performance gap between gilts and barrows

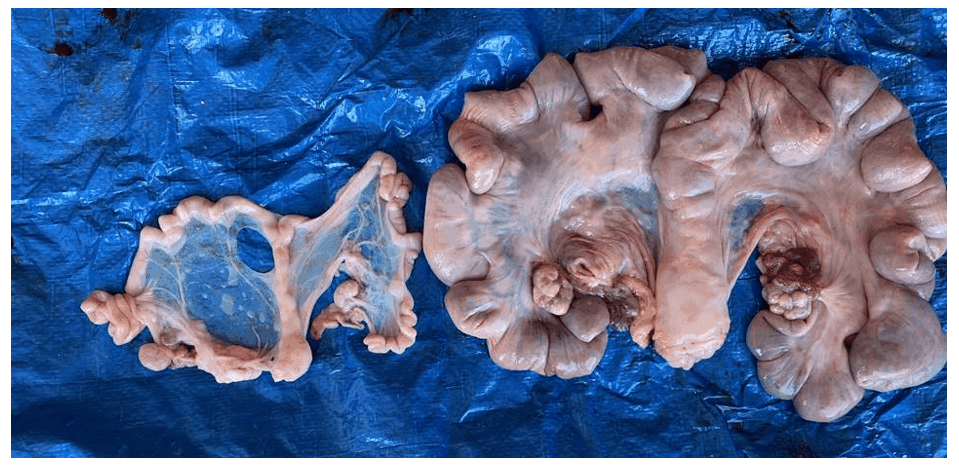

Comparison illustrating female reproductive tract of market weight gilts; pre-pubertal on the left, cycling on the right. Final report: TI-06444 (project 20PRGIMV-01-04)

Genetic selection for earlier maturing gilts in the breeding herd creates the possibility for development of estrus in market gilts. Rodrigues et al. (2018) showed that gilts showing estrus had 5.5 times heavier ovaries and 13.9 times heavier uteri compared to non-cycling gilts.

The weight of the female reproductive tract for market gilts slaughtered at 285 lbs live weight was reported by Boler et al. (2014) to weigh 1.39 lbs. Other research shows that either performed oophorectomies, the surgical removal of the ovaries, or immunological suppression of ovarian activity can reduce the weight of the female reproductive tract of market gilts by up to 75%.

“However, what we care about even more is the potential for energy and nutrients diverting away from estrus development and female reproductive tract development and shifting those nutrients towards lean growth,” said Dr. Woodworth.

Dr. Woodworth believes if the nutrients can be used toward lean growth rather than development of the female reproductive tract, it will be a more efficient process that is likely connected to the 5% advantage in average daily gain seen in barrows compared to gilts.

“Anytime you're diverting energy, the animal is going to lose performance,” Dr. Woodworth said. “While the industry seems to just accept the lost performance associated with gilts, there may be opportunities through technology to improve that deficit. The goal is to narrow the gap from a performance standpoint, as well as from a financial standpoint between gilts and barrows as it could make a big difference in profit potential for producers.”

Sort loss with market gilts

The marketing weight target for pigs is usually between 270 to 290 lbs live weight. Sort loss is the percentage of pigs that fall outside of the ideal window established by each packer. To compensate for pigs that aren’t ready to market, several groups of pigs will be marketed over a marketing window, which is typically three to four weeks. For example, the heaviest 10% of the finishing barn will be marketed first as one group. A week later, another 30% of the finishing barn will be marketed. Then the remaining 60% of pigs in the finishing barn will be marketed.

“What we notice as part of this process is that in the last group of pigs to be marketed, there will be a much higher percentage of gilts than barrows because barrows grow faster than gilts,” said Dr. Bohrer. “If we can narrow the gap in growth rate between gilts and barrows and make the last group have fewer light pigs, there's an economic incentive that is related to variation that doesn't necessarily show up when we're just looking at population averages.”

Carcass composition and quality

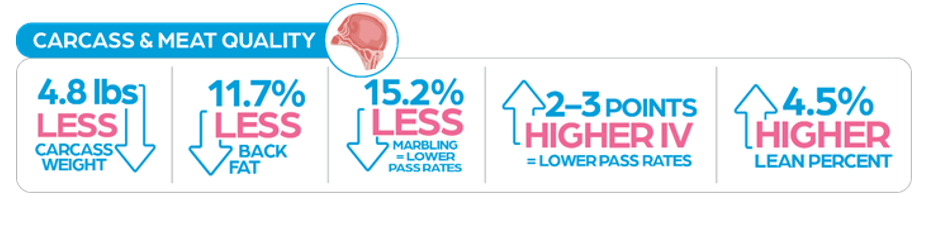

From a carcass composition and meat quality standpoint, gilts are typically trimmer than barrows. The study indicates gilts typically have 11.7% less back fat, 15.2% less marbling, 2 to 3 points higher iodine value and 4.5% higher lean percentage. Considering carcass weight, gilt carcasses are approximately 4.8 pounds lighter when compared with barrows.

“It's important that we fully describe the improved leanness observed in gilts compared to barrows because leaner carcasses have historically been thought of as a good thing. Oftentimes, there is a lean index system that will pay producers more for leaner carcasses,” Dr. Bohrer explained. “However, from a meat quality perspective, extremely low levels of back fat, for example carcasses with less than a half inch of back fat, create challenges with fabricating several merchandised cuts such as loins and bellies which can result in lost value for meat processors.”

In terms of marbling, gilts have less marbling compared with barrows – in the range of 0.5% intramuscular fat (IMF) or half of a marbling score unit. A 2- to 3-point higher iodine value has also been reported in gilts compared with barrows which is indicative of softer fat.

Marbling and iodine value’s impact on export rates

For pork to meet the standards necessary for premium export markets, color, marbling and fat quality must meet specific minimum standards.

“Fat firmness is perhaps the most valuable parameter for Japanese markets, and marbling is critical for premium market segments, but both are important from an export standpoint as well as for those trying to target premium markets and quality-based branding programs domestically,” noted Dr. Bohrer.

Based on the literature review, gilts are at a deficiency compared to barrows in these areas, and it really comes down to the differences in fat deposition during the finishing phase of production.

“With gilts being lighter and trimmer than barrows, lower value carcasses and lower value meat cuts are the outcome. This is a really important consideration, and I don’t believe it’s being fully quantified or fully recognized by the meat processing industry at this time,” said Dr. Bohrer.

The Gilt Gap in dollars and cents

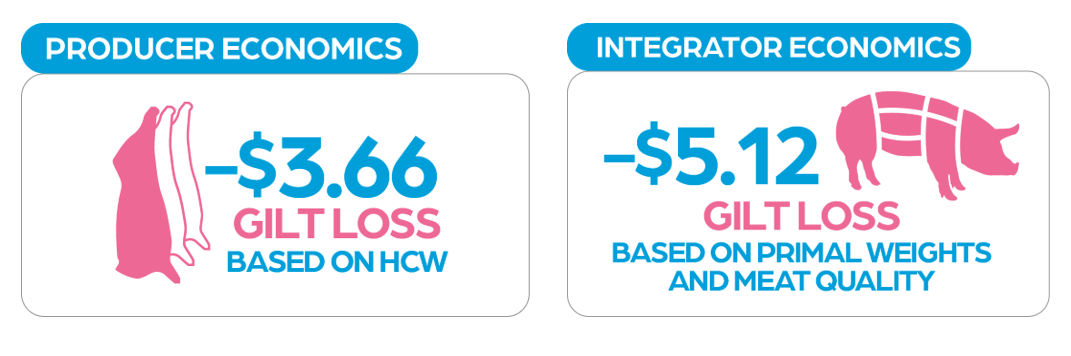

Assuming a fixed time scenario and the slower growth rate, lighter carcass weight and poorer meat quality of gilts when compared with barrows, a US$5.12 loss in value is estimated for integrated operations. Looking specifically at the production side – not including carcass and meat quality characteristics – there’s a US$3.66 loss in value for gilts compared with physically castrated barrows.

“Overall, gilt carcasses are less valuable to the processor than barrow carcasses, and the $5.12 loss that we’ve estimated doesn’t account for profitability associated with fabrication beyond primal pieces,” Dr. Bohrer said. “These losses would add up very quickly for a swine operator of any size or scale. Ideally, it would make sense for the swine industry to begin managing gilts differently than barrows to close the gap in economic value.”

Learn more about The Gilt Gap at www.builtforthegilt.com.