Australian Pig Meat: Outlook to 2018-19

Pig prices are forecast to fall in 2014–15, reflecting higher supply as imports rise, according to Clay Mifsud in the 'Agricultural Commodities' report from the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) for the March Quarter 2014.While exports are forecast to rise in 2014-15, they will remain a small part of the industry at around 15 per cent of production.

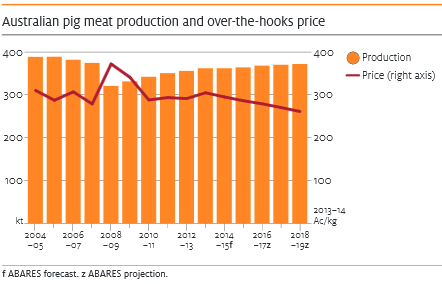

Over the medium term, pig prices are projected to decline in response to increased imports.

The Australian weighted average over-the-hooks price of pigs is forecast to increase by seven per cent in 2013-14 to 305 cents a kilogram (dressed weight). This reflects increased demand for locally produced pig meat in the domestic processing sector.

The total supply of pig meat in Australia in 2013-14 is expected to fall, as a forecast decline in imports is expected to more than offset a small forecast increase in domestic production.

In 2014-15, the weighted average over-the-hooks price of pigs is forecast to decline by one per cent to 302 Australian cents a kilogram. The total supply of pig meat in Australia is forecast to rise as a result of increasing imports. This is expected to result in increased competition for local producers who supply the domestic pig meat processing sector.

Over the medium term, pig prices are projected to decline gradually, to 261 cents a kilogram by 2018-19 (in 2013-14 dollars). Downward pressure on pig prices over the medium term reflects a gradual increase in competition from imports of pig meat destined for processing. Imports from North America and the European Union are projected to remain competitively priced, despite the assumption of a weaker Australian dollar over the medium term.

| Table 1. Outlook for pig meat | ||||||||

| 2011-12 | 2012-13 f | 2013-14 z | 2014-15 z | 2015-16 z | 2016-17 z | 2017-18 z | 2018-19 z | |

|---|---|---|---|---|---|---|---|---|

| Over the hook price a | ||||||||

| - nominal, A¢/kg | 281.0 | 285.0 | 305.0 | 302.0 | 300.0 | 300.0 | 298.0 | 295.0 |

| - real b, A¢/kg | 294.0 | 291.0 | 305.0 | 295.0 | 286.0 | 279.0 | 270.0 | 261.0 |

| Slaughterings, '000 | 4,733 | 4,745 | 4,802 | 4,800 | 4,850 | 4,900 | 4,950 | 5,000 |

| Production c, '000 tonnes | 351.0 | 356.0 | 362.0 | 362.0 | 365.0 | 368.0 | 371.0 | 374.0 |

| Consumption per person, kg | 25.4 | 26.0 | 25.7 | 25.9 | 26.0 | 26.2 | 26.5 | 26.8 |

| Import volume d, '000 tonnes | 141.9 | 152.3 | 137.0 | 145.0 | 150.0 | 155.0 | 160.0 | 165.0 |

| Export volume de, '000 tonnes | 29.4 | 26.2 | 27.1 | 28.0 | 29.0 | 30.0 | 30.0 | 30.0 |

| Export value | ||||||||

| - nominal A$ million | 100.1 | 81.2 | 85.0 | 88.2 | 90.7 | 93.3 | 92.5 | 92.4 |

| - real b, A$ million | 104.6 | 83.0 | 85.0 | 86.2 | 86.6 | 86.8 | 83.9 | 81.8 |

| a Dressed wt; b In 2013-14 A$; c Carcass wt; d Shipped wt; e Excludes preserved pig meat f ABARES forecast; z ABARES projection Sources ABARES, Australian Bureau of Statistics |

||||||||

Production to Rise over Medium Term

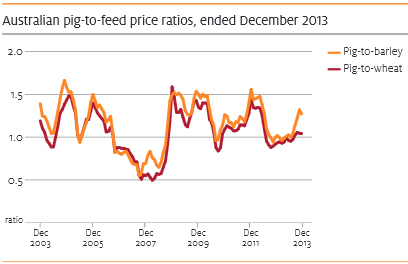

Australian pig meat production is forecast to rise by two per cent in 2013-14 to 362,000 tonnes. Lower imports have resulted in upward pressure on pig prices, leading to increased returns from production. Over the first six months of 2013-14, the pig-to-wheat and pig-to-barley price ratios (indicators of returns from pig production) averaged 12 per cent and 19 per cent higher, year-on-year.

In 2014-15 production is forecast to remain steady at around 362,000 tonnes. With competition from imports forecast to rise in 2014-15 and domestic feed grain prices assumed to stay high, it is unlikely that domestic production will expand.

Pig meat production is projected to rise gradually over the medium term, increasing to 374,000 tonnes by 2018-19. Over this period, more domestic production is expected to be directed to the fresh pig meat market. This is under the assumption that the fresh meat market will remain closed to imports because of biosecurity concerns, while the processed pig meat sector will remain open to competition from imports. Currently, all imported pig meat must be processed before sale, usually into bacon, ham or small goods.

Domestic Consumption to Rise over Medium Term

Australian per person pig meat consumption increased by 16 per cent over the 10 years to 2012-13 to an average of 26kg. Pig meat imports, as a share of domestic pig meat consumption, grew from 27 per cent in 2003-04 to an estimated 47 per cent in 2013-14. Over the medium term, average per-person consumption of pig meat is projected to rise to around 27kg in 2018-19.

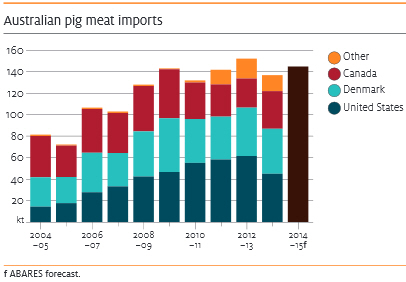

Imports

Deboned pig meat imports are allowed into Australia from approved countries subject to specific import conditions. Because of quarantine restrictions, all fresh pig meat sold in Australia is domestically produced.

In 2013-14 Australian pig meat imports are forecast to fall by 10 per cent to 137,000 tonnes (shipped weight), reflecting lower imports from the United States. US pig prices averaged 10 per cent higher, year-on-year, over the first six months of 2013-14. Pig meat imports from Canada and Denmark have been largely unchanged.

In 2014-15, Australian pig meat imports are forecast to increase by six per cent to 145,000 tonnes. An increase in imports from the United States is forecast because US pig prices are expected to fall from their peak in 2013-14. Imports from Denmark and Canada are forecast to be steady. Over the medium term, Australian pig meat imports are projected to increase gradually, reaching 165,000 tonnes by 2018-19.

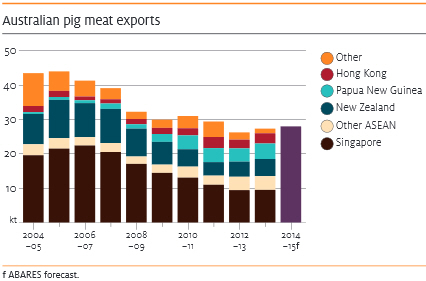

Exports to Rise Marginally to 2018-19

Australian pig meat exports are forecast to increase by three per cent in 2013-14 to around 27,000 tonnes (shipped weight), with Singapore and New Zealand the largest markets. The assumed lower Australian dollar is likely to make Australian pig meat more price competitive in export markets. Over the medium term, Australian pig meat exports are projected to rise, reaching 30,000 tonnes by 2018–19.

March 2014