Economist: US pork producers benefit from lower feed costs and strong export momentum

With hog margins at their best levels since 2021, US pork is leaning on efficiency, heavier carcasses and global demand to drive profitability

Brian Earnest, lead animal protein industry analyst at CoBank, shared a wide-angle view of how macro trends are reshaping food demand before diving deeper into the impact on exports, consumption and market opportunities for the US and global pork industry at the Four Star Pork Industry Conference in Muncie, Indiana.

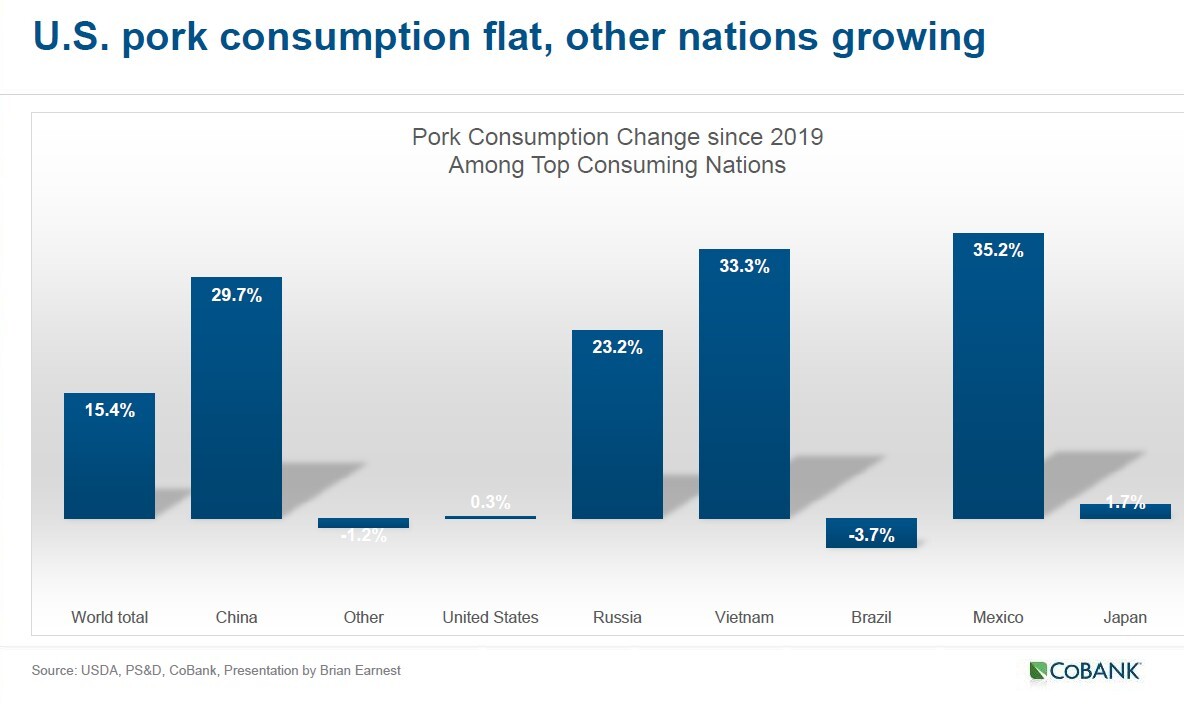

US pork consumption has plateaued, but global demand is expanding.

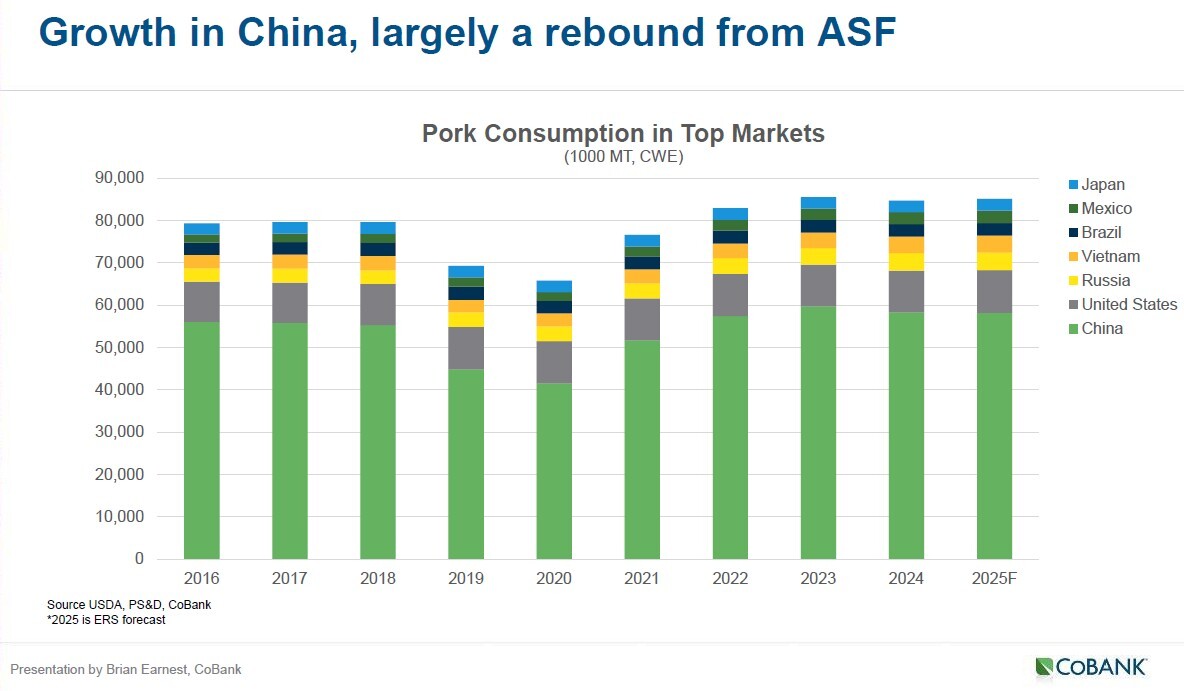

“Global pork consumption is up 15% from where it was in 2019,” he said, citing USDA data.

Most of that rebound, he explained, comes from China’s recovery after African swine fever, along with growth in Vietnam and Mexico. In the US, pork’s bright spots are value-added and flavor-driven categories.

“We’ve seen two items that US pork has been leaning on heavily – sausage-type items and pizza toppings,” Earnest said. “Pork 42s (pork trimmings that consist of approximately 42% lean meat and 58% fat) and 72s (pork trimmings with a lean-to-fat ratio of roughly 72% lean meat and 28% fat) really got a huge lift in 2020, and they haven’t really come back from those levels.”

Bacon also remains a powerhouse. Together, those processed categories have kept trim prices high even as other segments face headwinds.

He noted the National Pork Board’s new marketing campaign, “Taste What Pork Can Do,” as a smart repositioning effort.

“Younger consumers don’t necessarily understand how to handle a pork loin or ham,” Earnest said. “This campaign is a reflection of not only a change in the consumer but also the attributes that pork can bring through reimagining.”

The message—flavor, versatility, and ease of preparation—aligns neatly with consumer trends toward premium yet convenient foods.

Internationally, Mexico has emerged as the anchor market.

“Roughly 50% of Mexico’s pork consumption is foreign-sourced, and the US is a strong source for that,” Earnest said.

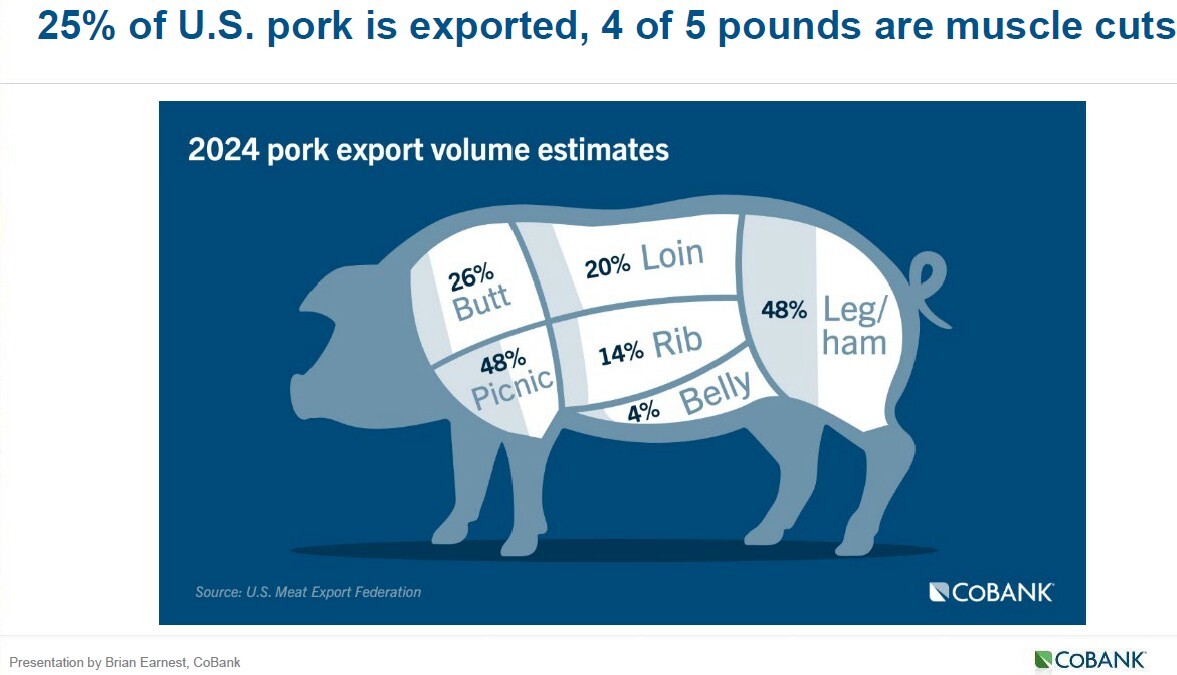

Exports now account for roughly a quarter of all US pork production, and four out of every five exported pounds are muscle cuts rather than variety meats. The remaining fifth – feet, tongues and other offal – still generates substantial value abroad.

“There’s no value for that last fifth in the US, but they are $3 a pound in China,” he said, illustrating how exports transform by-products into revenue.

Farm-level economics and producer margins

While demand trends favor animal protein, producers continue to navigate economic pressures. Crop receipts have fallen sharply since 2022, with corn and soybeans leading the decline. But for livestock producers, lower feed costs are a welcome relief.

“Hog values and corn prices are falling in favor of pig producers,” he noted.

The correlation is visible in Earnest’s data comparing national feeder-pig prices with Omaha corn prices. Feed costs have dropped while hog values have remained firm, widening margins.

“Now looking at these lower corn values, hog prices are still holding well – this looks quite good from a producer’s perspective,” he said. Iowa State University’s profitability models confirm that “we’re in some of the best levels that we’ve seen since 2021 in terms of producer margins.”

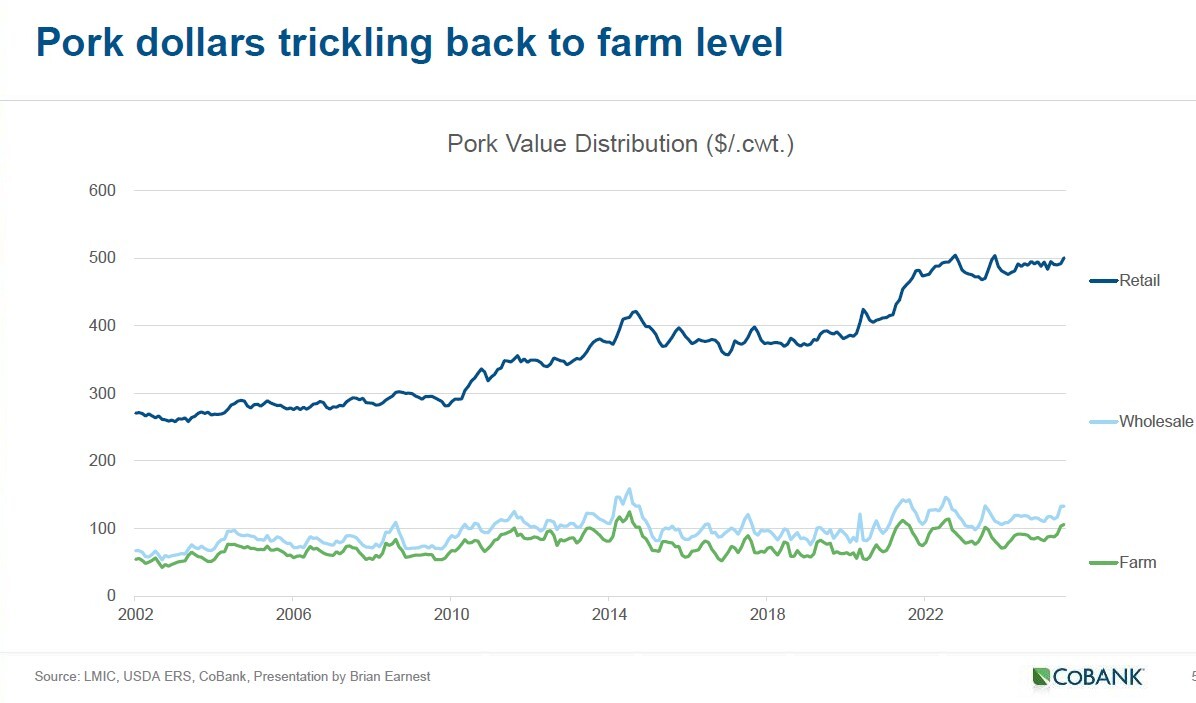

Still, not all revenue reaches the farm gate. Retail pork prices have risen from roughly $3 per pound in the early 2000s to $5 today, while the farm share of that value has declined. Earnest illustrated the widening gap between wholesale, retail and farm-level prices. Even as market hog values improve, he said, “Those pork dollars coming back to the farm level are not necessarily keeping pace with what the dollars are at retail.”

Structural efficiency remains the industry’s answer. Average live weights for hogs, cattle and broilers all increased in 2024.

“They’re not necessarily adding head count,” Earnest explained. “We’re adding more weight. Part of this is the low-feed-cost environment, but also spending more days on feed has contributed to elevated live weights this year.”

Doing more with fewer animals – literally heavier carcasses – helps offset production constraints.

Global competition and market position

Globally, the US pork sector is regaining ground as a top exporter. USDA data show the US overtaking the European Union in pork exports. Earnest credited efficiency, genetics and consumer-driven product development for the competitive edge. He noted that exports have become “a key feature of pork disappearance”, meaning a growing share of US production is consumed abroad rather than domestically.

China’s influence remains outsized.

“We’re seeing China’s needs for animal protein being supplied more and more by domestic production than relying on imports,” Earnest said.

Nevertheless, the US remains a key supplier for high-quality pork cuts, variety meats and genetics.

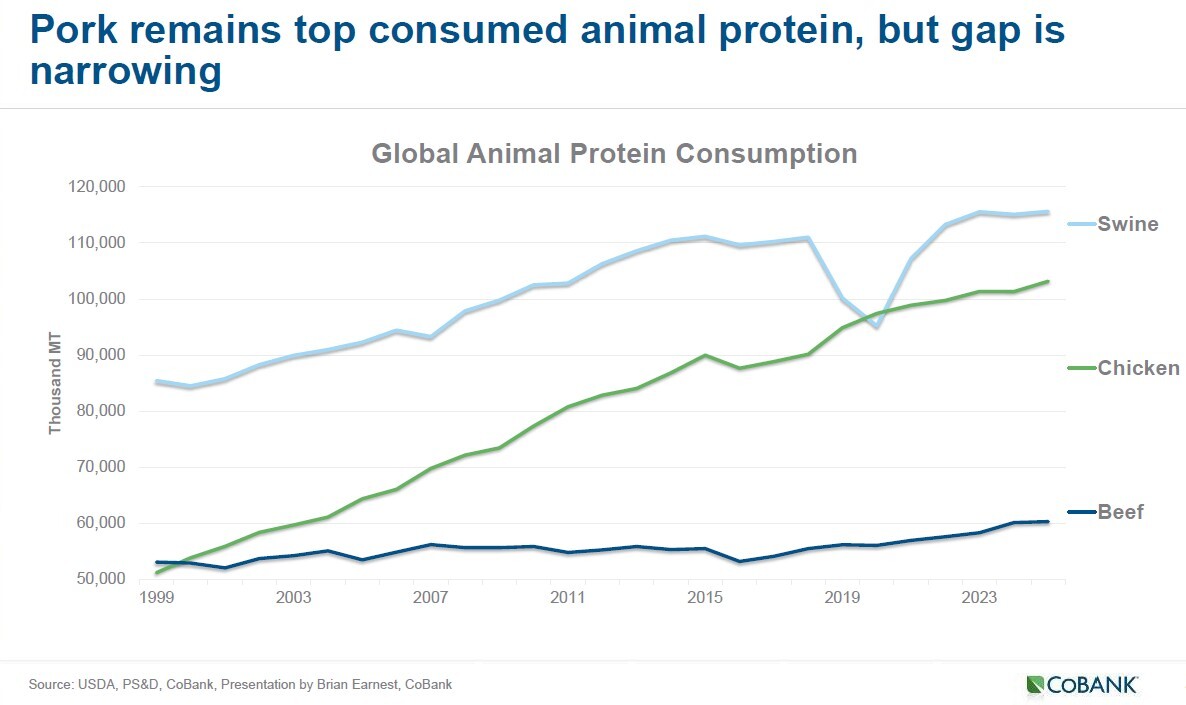

As for competition from poultry, Earnest acknowledged that chicken is “nipping at the heels of pork” as the world’s top protein. Low feed costs and faster production cycles give poultry an edge, but he believes pork still has room to grow through flavor innovation and export diversification.

Efficiency and opportunity ahead

Earnest closed by summarizing the paradox facing livestock producers: strong demand, favorable feed economics, and improving margins – all set against labor shortages, high capital costs and policy uncertainty.

“Farm economics are tilted towards producers, but obstacles remain,” he said.

His overarching message was one of cautious optimism.

“Animal protein demand remains robust,” he said. “Livestock meat and poultry values are firm, trade has been growing and diversifying in recent years. Tariffs are seen as detrimental to animal protein trade. Animal feeders are reaping the benefits of lower feed values, but other input factors are hampering growth.”

For pork producers in particular, the next growth phase may come not from expansion but from reimagination – capturing new consumers through flavor, convenience and global reach. The industry’s task, Earnest concluded, is to meet changing consumer preferences without losing sight of operational fundamentals.