The Power of Protein: Consumer appetite outpaces economic headwinds

Despite inflation and labor tightness, CoBank economist Brian Earnest says animal protein demand “has been phenomenal”

Brian Earnest, lead animal protein industry analyst at CoBank, shared a wide-angle view of the US economy and how macro trends are reshaping food demand at the Four Star Pork Industry Conference in Muncie, Indiana. His first point was straightforward: America’s consumers and its workforce are aging.

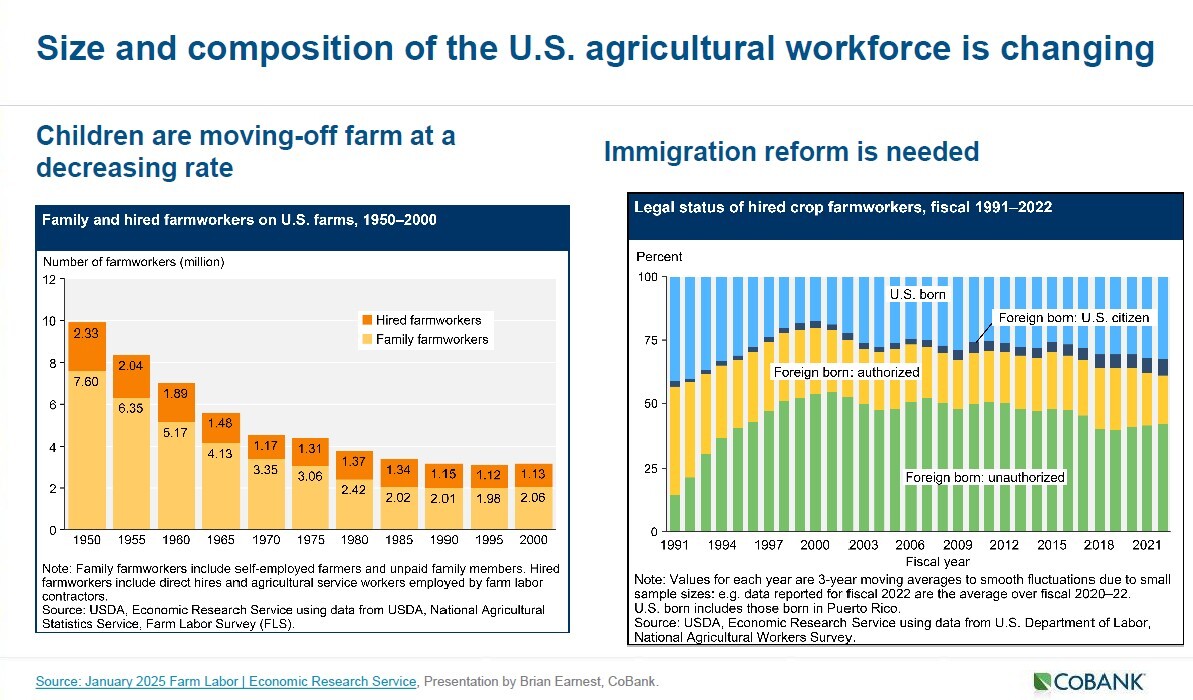

The demographic shift he described has two sides: fewer young people are entering the labor force and more older people are retiring.

“We aren’t producing as many young people today, but we’re producing more older folks,” Earnest said. “This continues to set the expectation that we’ve got a tightening labor supply.”

The data support his argument. Labor-force participation peaked at 67% in the late 1990s, dipped sharply during COVID-19 and levelled off near 62%. The result, Earnest explained, is a permanent shortage of working-age Americans, especially in labor-intensive industries like agriculture and food processing.

Less than 2% of all US employment is now in agriculture compared to 20% in the 1940s. Technology has filled some gaps, but animal production and processing remain hands-on jobs that require people in barns and packing plants.

“The amount of workers that we have participating in the labor force today probably doesn’t get much bigger than where we’re at,” he said.

Labor, immigration, and agriculture’s changing workforce

While the labor pool shrinks, immigration has provided a temporary offset. Earnest noted a surge of 5 to 6 million working-age immigrants between 2022 and 2024 that “bucked the trend” of decline. That addition, he said, was vital for US agriculture which has long relied on immigrant labor.

In the 1950s, about three-quarters of farm labor came from family members. Today, Earnest said, that share has dropped to roughly one-third, forcing farms to depend on non-family and often foreign workers.

“The agriculture industry is more heavily reliant on a foreign workforce,” he said.

Public opinion about immigration, he added, has grown less negative. Americans are “less concerned about what’s going on with immigrants in the US than they were 20 years ago,” he noted. This is an encouraging signal for agricultural employers who depend on those workers. Nevertheless, policy uncertainty around visas and reform continues to complicate workforce planning, particularly for livestock operations that need trained animal-care and processing companies who need employees year-round.

The combination of aging domestic workers, declining family labor, and volatile immigration policy underscores a structural challenge for US animal agriculture: there simply aren’t enough people to do the work and replacing them with automation can be difficult. That imbalance, Earnest suggested, will continue to drive consolidation, efficiency and productivity gains in protein production.

Tariffs, trade deficits and global market shifts

Turning to policy and trade, Earnest described a volatile tariff environment that has shaped markets throughout 2025.

The US–China trade dispute remains central. Under current policy, US tariffs on Chinese goods reach 145%, while China’s tariffs on US products are roughly 125%. Exceptions exist for consumer electronics, but agriculture has not been spared.

“The outline here of the timeline of what we’ve seen from the announcement of tariffs and the change in that provides a lot of uncertainty in the system itself,” Earnest said. “We’ll continue to see that uncertainty as we make our way through 2025.”

He cautioned that tariffs may have longer-term inflationary effects, and we could start to feel the impact of tariffs more heavily in the back half of the year than we did in the front half of 2025.

Meanwhile, trade data suggest that exporters are finding creative ways around tariffs. Imports from China have fallen sharply, while goods shipped from Vietnam and Taiwan have surged. If new tariffs extend to those countries, he warned, trade volumes could slow further.

The US agricultural balance sheet has also flipped. After a trade surplus in 2021, the US Department of Agriculture projects a $47 billion agricultural trade deficit for 2025.

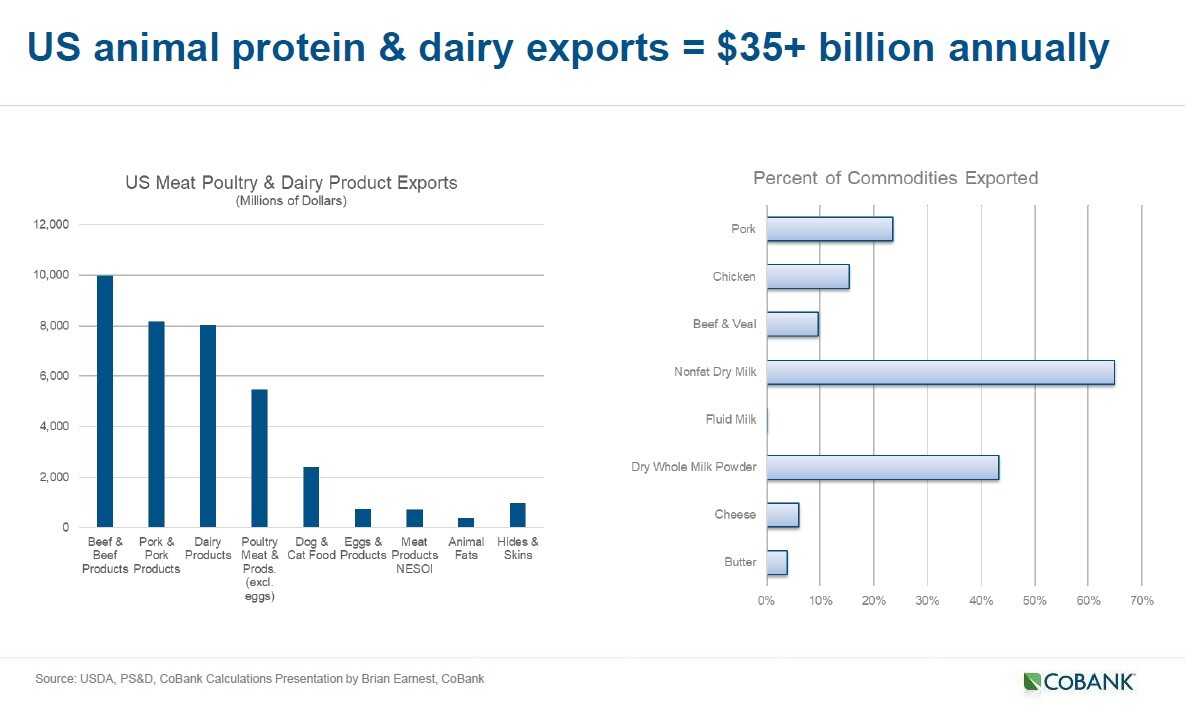

Losses are concentrated in horticultural and tropical products, while grains and oilseeds still post strong exports. Animal protein and dairy remain a $35-billion export business, but overall trade headwinds are intensifying.

“Global pork demand is in good shape,” Earnest said. “But headwinds are occurring in trade barriers.”

Animal protein: Efficiency, demand and consumer behavior

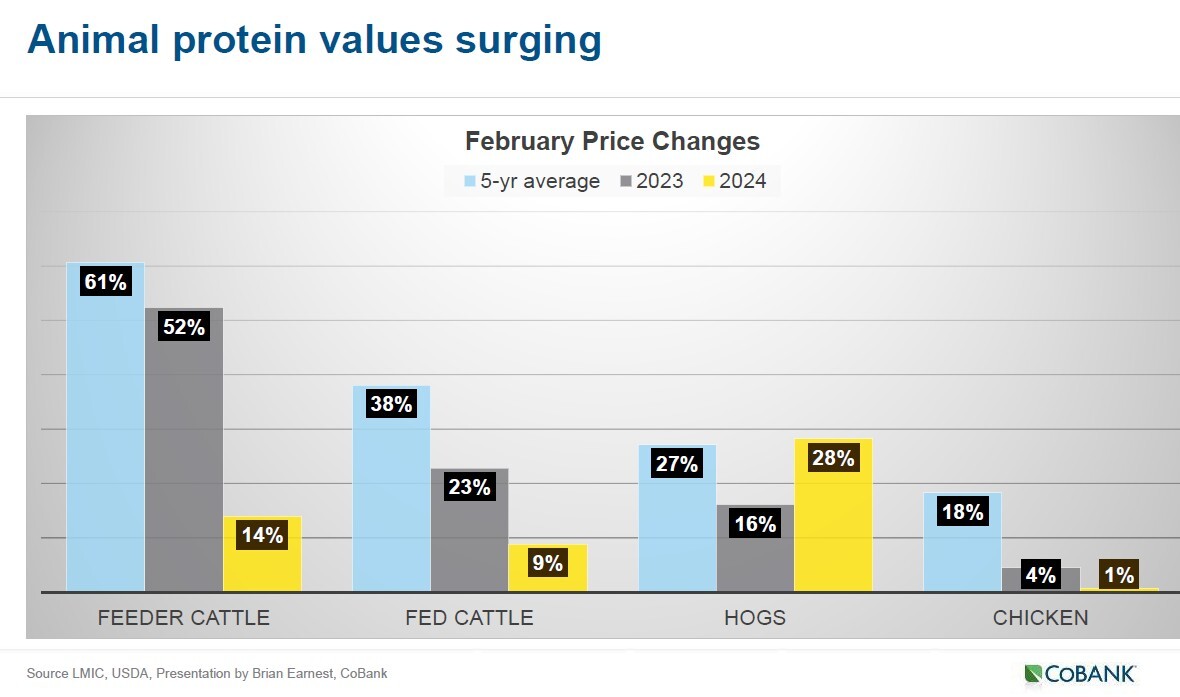

Despite economic turbulence, demand for animal protein has remained remarkably strong.

“Animal protein in general has experienced fantastic demand in recent years,” Earnest said. “Specifically, we’ve been talking a lot about beef this year and the phenomenal support that’s been there, but I think it spreads throughout animal protein in general.”

US consumers are buying more meat across nearly all categories. Per-capita consumption of beef, pork and chicken has climbed, with chicken seeing the most striking gains – nearly 19 additional pounds per person over the last decade. Beef and pork have grown more modestly, about five pounds each, while turkey consumption has slipped. That growth, Earnest said, reflects both changing consumer habits and improved marketing.

“The demand picture for animal protein has just been a phenomenal story over the last couple of years,” he said. “Through the COVID era consumers realized that they can create a great meal at home that is similar to a restaurant-style experience.”

The rise of at-home cooking created a structural shift in how meat is purchased and prepared.

Consumers also view meat as fitting neatly into popular health narratives, including high-protein diets and newer weight-management drugs.

“The GLP-1 medication plays into a narrative that fits very well with animal protein,” Earnest said, referring to medications originally designed for diabetes that influence appetite and weight. “Protein products fit the dietary needs of users; it’s what consumers are looking for in their diet with these medications.”

Yet production growth has been muted. Lower feed prices would normally trigger expansion, but Earnest pointed to “higher interest rates and higher capital costs and tight labor supplies that really suppress the urge for the industry to expand at levels that we’ve seen in the past.” The sector, he said, is “doing more with less” by raising heavier animals and improving efficiency rather than adding head count.

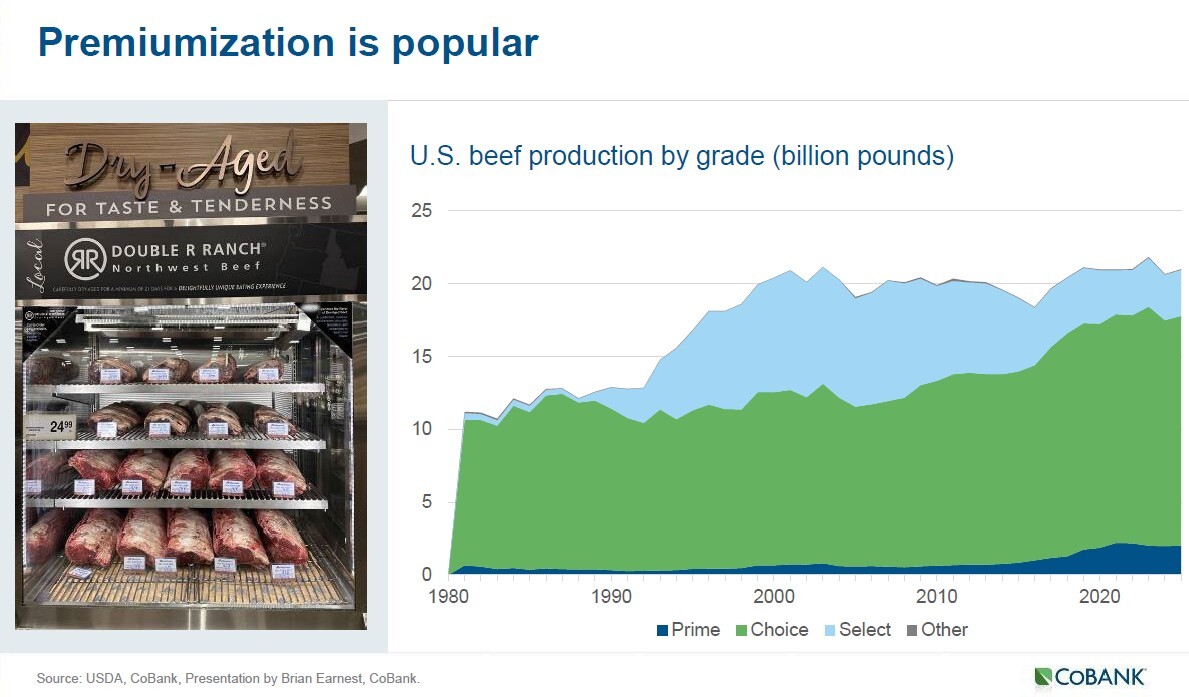

Premiumization, quality and the “Air Fryer” generation

Earnest said we are seeing a changing face of meat marketing and consumption. Quality and convenience, not price alone, now drive purchases. He highlighted Kansas State University’s Meat Demand Monitor, which consistently finds that “taste, freshness, price and nutrition” top the list of consumer priorities, while animal welfare, origin and environmental impact rank lower.

“The consumer expects that the producer is being responsible,” Earnest said. “They generally think that the industry is doing a good job when it comes to these factors.”

At the same time, Americans are trading up.

“The American consumer has greater access to high-quality beef than they ever have before,” Earnest said. “If I really wanted that high-quality experience with a steak, I had to go to a high-end restaurant. Now I can go to the local grocery store and grab it.”

That “premiumization” trend parallels a surge in convenience-focused appliances. Earnest featured a familiar gadget: the air fryer.

“There are more of air fryers in US consumers’ households than coffee makers,” he said. For meat processors, the implication is clear: “We need to be thinking about that in the animal protein space as well,” he said.

Frozen chicken product packaging now carries air-fryer instructions, he noted, but pork has lagged behind in capturing that convenience-oriented audience.

Inflation, beef prices and consumer spending patterns

While meat remains a staple, consumers are adjusting their spending amid inflation. Earnest showed data indicating that real consumer spending has “fallen off trend.” Food inflation has cooled off from its pandemic peaks, but beef prices continue to climb to record levels. Ground beef and other beef cuts have become the costliest proteins at retail, while chicken prices have declined and pork has held steady.

Retail beef inflation stems from tight cattle supplies. US beef-cow inventories are the lowest since 1961 amid strong demand.

“Fed cattle values are still up nearly 40% from the five-year average,” Earnest said.

Tight supplies, high quality grades and strong consumer appetite combine to support elevated prices. By contrast, pork’s moderate pricing and versatility have positioned it as a value choice for shoppers and restaurants navigating higher costs.

Inflation and household budgets are nudging people back toward home-cooked meals, which is a positive sign for retail meat sales.