Global Pig Meat Trade Hit by Two Diseases

Global pig meat production and trade have been hit by two major health and welfare issues in recent months, writes Chris Harris.In the US and North America the pig herds and the market have been severely affected by the outbreaks of Porcine Epidemic Diarrhoea virus that has reduced the slaughter herds and forced prices up.

In Europe, the discovery of African swine fever in two wild boar in Lithuania and Poland and the subsequent ban on all exports of pig meat from the EU to Russia and the neighbouring Customs Union countries has rocked the European pig met markets.

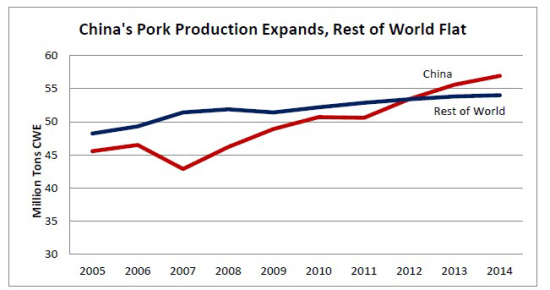

Between November last year and April this year global pork production rose by 1.8 million tonnes to a record 110.7 million.

This growth in global production is largely the result of growth in China and Russia and has more than offset reductions in the United States and the EU.

However, industry economists predict that global trade is going to fall, with exports reduced by nearly 400,000 tonnes to 6.9 million in the first part of this year.

This is largely due to Russia’s restrictions on imports of EU pork as well as

tight supplies that are now available for export from the United States.

China’s Production Expands Despite Low Prices

China that accounts for more than half the global pork production, is expected to see production rise by 2.3 million tonnes to a record 57.0 million because of fewer swine disease outbreaks and better animal nutrition and genetics resulting in heavier slaughter weights.

Government intervention programmes are encouraging producers to stay in business despite low or even negative returns. For example, the government has a pork purchasing scheme and some provincial governments have implemented both hog

subsidies and insurance trials, all attempting to prevent significant fluctuations in pork production.

Source:USDA

Source:USDAHowever, while some analysts, including those at the USDA, are optimistic about a rise in production in China, a note of caution has been sounded by the Genesus senior consultant Ron Lane on the ground in China.

Mr Lane said that looking at the size of the breakdown of the inventory for February, 2014, the information from the Chinese Ministry of Agriculture is difficult to determine the basic numbers, but there appears to be quite a large drop in on farm inventory and a drop in breeding stock numbers over the past few months.

The Ministry of Agriculture says that January on farm inventory was down 4.2 per cent and breeding stock was down 0.6 per cent from the previous reporting period.

Compared to November 2013-breeding stock was around 50.33 million and total on farm inventory was around 458.75 million.

“If one compares to November 2013, then about 19.27 million pigs in inventory changed (decreased) so that on farm inventory would be 439.48 million head for January 2014,” Mr Lane reported.

“This seems like an extreme number and it could be that the original count has been adjusted or other factors such as disease, cold weather and/or home consumption (mainly backyard farms) for Spring Festival, have all affected the total on farm inventory.

“For January, 2013, the breakdown of the inventory for breeding stock was around 51.30 million and total on farm inventory was around 446.79 million (again from the January 2014 report from MOA, it states that on farm inventory was down 2.2 per cent from January 2013-thus for January 2014, a total of 436.96 million head.

“Calculations by either way means a large drop in on farm pig inventory reported for January 2014.

“Now if we take an average for January 2014 of 438.2 million on farm inventory and we calculate the sow herd at 50.0 million, then February, 2014 inventory would be 433.03 million head ( down 0.9 per cent from last month and down 1.1 per cent from last year). Breeding stock would be 49.6 million sows (down 0.8 per cent from last month and down 3.5 per cent from last year),” Mr Lane said.

Russia’s Import Restrictions Impact Domestic EU Production

Russian pig meat production has been boosted by 250,000 tonnes to a record 2.6 million, largely on greater producer returns resulting from tight supplies caused by import restrictions on EU pork.

US market watchers say that the Russian industry continues shifting to larger, more efficient operations.

The government is supporting the modernisation of pork production facilities, including subsidising improved breeding stock and genetics through the “Pork Production Development in 2013-2015 Plan.”

Small farms, on the other hand, are poorly positioned to compete with large-scale operations and are being encouraged to exit hog production in order to reduce African swine fever risks.

With import restrictions in place against pork from the EU, the expanding industry is poised to benefit from higher prices.

EU share of the Russian market is cut by 150,000 tonnes to 22.3 million as the loss of their top export market, Russia, limits gains in hog and pork prices, which remain below last year. Weights remain near last year’s level.

Slaughter is eased as the outlook for recovery in piglet production is weakened largely due to pressure on producer returns.

North American Production Is Lowered on PED Impact

According to Rabobank Porcine Epidemic Diarrhea Virus has hit about 60 per cent of the US breeding herd, 28 per cent of the Mexican herd and is beginning to develop in Canada.

Rabobank says that if PEDv spreads in Canada and Mexico at the pace seen in the US, North American hog slaughter could decline by nearly 18.5 million hogs over 2014 and 2014 or 12.5 per cent relative to 2013 levels.

Overall US pork production is anticipated to decline between six and seven per cent, the most in more than 30 years.

"In the US we see the outbreak of PEDv causing a significant shortfall in the availability of market hogs in 2014 to the tune of 12.5 million hogs or 11 peer cent of annual slaughter," said Rabobank Analyst William Sawyer.

"Given the ever rising number of PEDv cases reported, coupled with a six-month average lifecycle, the months of August through October are likely to be the tightest for processors where slaughter could decline by 15 per cent – 25 per cent against 2013 levels. If the virus continues at its current rate, the shortfall to US slaughter in 2014 could be as much as 15 million hogs."

US analysts forecast that because of the effects of PED, production in the United States is down by around 453,000 tonnes in the first part of this year to 10.3 million tonnes.

Heavier weights, however, are not expected to be enough to offset tighter hog supplies.

The USDA said that beginning swine inventories fell by 1.8 million head to 66 million.

Piglet production is also reduced by 8.7 million head to 113.2 million as PED losses of pre-weaned piglets result in lower litter rates.

Tight hog and pork supplies are expected to lead to higher prices for both domestic and export markets.

To date, the spread of PED in Canada has not been as severe as in the United States, with approximately 50 cases reported in four Canadian provinces as of mid-April.

However new cases are being reported virtually every week in provinces such as Ontario and Manitoba.

Canada’s production was down 30,000 tonnes to 1.8 million tonnes by April, making it unchanged compared to 2013.

However, Bob Fraser from Genesus Ontario says that the market hog price in Canada nearly doubled in a week.

He said that the margin after feeder pig and feed went from C$68.30 to C$126.82 in a mere five weeks.

“Producers have had little time to adjust to the fact that they’re making money (let alone a lot of money) after ten years wandering in the wilderness,” said Mr Fraser.

“Also Canadian producers can hardly be blamed for being nervous of their newfound fortunes.

“How many times has the proverbial “light at the end of the tunnel” proved to be a train! The list is long – ongoing COOL frustrations, swine flu, seven dollar plus corn, rapidly appreciating CDN dollar to name a few.

“So now the “perfect storm” of shortened supply (due to PEDv), smallest cattle herd in living memory, a vastly depreciated CDN dollar and the cheapest corn in North America can seem to be ‘all too good to be true’,” he said.

Canada’s trade in pig meat is on the rise and expected to go up by 20,000 tonnes to 1.3 million tonnes, with greater shipments expected to the United States, the country’s top market, because of the fall in production in the US through the losses caused by PEDv.

At the current time, PEDv is having a minimal impact in Mexico. Production is down by 5,000 tonnes to 1.3 million tonnes as heavier weights are expected to nearly offset lower slaughter.

According to Genesus in Mexico, the damage caused by PEDv will be less than three per cent of the Mexican production and this situation will not affect the Mexican pork meat supply.

However, external factors including PEDv in North America are expected to see a severe contraction in hog supplies in Mexico.

During the second half of 2013, PEDv affected states located in the Northwest and Central Mexico and there is a lack of information about which other states might be affected.

Asian Countries Also Impacted by PEDv

Production for Taiwan is down by 25,000 tonnes to 815,000 tonnes as PEDv losses are expected to reduce slaughter hog supplies.

Japan is unchanged at 1.3 million tonnes as heavier weights are expected to balance reduced slaughter.

Meanwhile in South Korea, production has gone up by 10,000 tonnes to 1.2 million tonnes with heavier slaughter weights more than offsetting PEDv losses.

In Viet Nam, pork is the leading source of meat products. Pork still represents 74.4 per cent of the total meat supply in Viet Nam.

During most of 2013, pig market prices showed a large variation with market pig prices falling sharply and until the middle months of 2013 around 38,000 to 39,000VND/kg ($1.79US/kg-$0.81US/lb. to $1.83US/kg-$0.83US/lb.), but since that time, the price has risen until it reached 55,000VND/kg ($2.59US/kg-$1.17US/lb.) as a high in December.

Viet Nam had 26.3 million pigs on farm at the end of December, a fall of 0.9 per cent compared to the same period last year. There is estimated to be 3.9 million sows (a decrease of 2 per cent compared with the same period last year).

Source:USDA

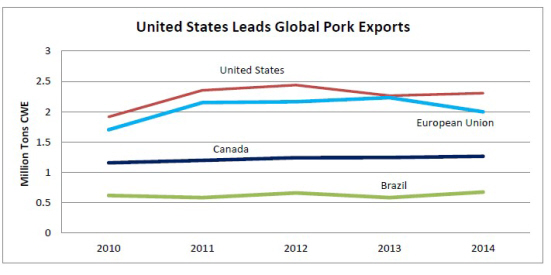

Source:USDAEU Constrained by Trade Restrictions, US by Tight Supplies

EU exports are forecast to drop by 200,000 tonnes to 2.0 million due to the loss of the top market, Russia, which accounted for 23 per cent of their trade in 2013.

Some shipments are expected to be redirected to Asia, with China expected to become the top market.

EU exports to the United States are also likely to increase.

Greater domestic consumption is also forecast, with growth from the central Member States.

Russia’s import restrictions were implemented at the end of February after cases of ASF were reported in Poland and Lithuania.

The EU has initiated a World Trade Organization (WTO) disputes case against Russia’s restrictions, because it says that the blanket ban on pork from the

entire EU is disproportionate and in violation of WTO rules.

The United States is expected to see a decline in production of 190,000 tonnes to 2.2 million tonnes as tight supplies and record high prices are hitting US competitiveness.

However, the United States has regained partial access to the Russian market, which had been closed since early 2013.

The export share of production for the US is now forecast to fall for the second year to 21 per cent.

Lower production and tight supplies are expected to boost imports, which are expected to go up by 25,000 tonnes to 415,000 tonnes.

Brazil Benefits from Trade Restrictions

Brazil is forecast to see production rise by 55,000 tonnes to 675,000 tonnes, with increased shipments to Russia replacing EU pork.

With an additional product becoming eligible to ship to Russia at the beginning of April, export prospects are now seen to be even better than before.

The depreciation of the Real is also expected to make Brazilian product more competitive in the world market.

Growth Is Expected for Some Smaller Exporters

China and Mexico are expected to see trade go up slightly on stronger Asian demand.

For Mexico, exports are forecast 5,000 tonnes higher to 125,000 tonnes mostly on Japanese demand, while China’s trade is up by 10,000 tonnes to 275,000 tonnes on ample, relatively low priced supplies with some demand growth expected from

Hong Kong, the Philippines, and Malaysia.

Imports Limited by Trade Restrictions Tight Supplies

Russia’s imports are down by 270,000 tonnes to 650,000 tonnes, the lowest level in 10 years, because of import restrictions on product from the EU, their largest supplier.

Larger shipments from Brazil and resumed access for two US plants are expected to replace some, but not all EU pork.

Despite greater production, consumption is down to 2012 levels.

Mexico and Canada have seen consumption fall because of tight supplies in the United States, their major supplier.

In Mexico consumption is down by 15,000 tonnes to 785,000 tonnes and Canada’s consumption is cut by 20,000 tonnes to 215,000 tonnes.

Japan is seeing consumption fall by 20,000 tonnes to 1.2 million tonnes with pork facing stiff competition from other protein sources.

The top suppliers are expected to remain the United States with 44 per cent of the market, the EU with 25 per cent and Canada with 17 per cent.

The EU could gain some market share due to more competitive prices and increased availability of product.

Some Japanese importers are also beginning to diversify their supply base and increase imports from lower-priced suppliers.

Slightly Higher Imports Forecast for China

China is predicted to see imports of pig meat rise by about 15,000 tonnes to 790,000 tonnes, but imports still only account for one per cent of consumption.

Greater shipments are expected from the EU, their top supplier.

May 2014