Expert speaks on volatility, mega-trends, role of early life in pig productivity and profitability

Editor’s note: Following is the first installment in a four-part series sharing highlights of the global event Life Start: Nourishing Animal & Business Potential. Hosted by Trouw Nutrition, the virtual event was attended by more than 1,100 people from 66 countries. John Pluske, Honorary Professorial Fellow at The University of Melbourne, delivered the day’s first address.Part of Series:

Next Article in Series >

The global pork industry is always volatile with a plethora of continuous challenges whether it’s grain harvests and their impact on feed prices or global trade, supply chain issues, environmental issues or disease challenges.

“Unfortunately, the appearance of new strains of African swine fever (ASF) virus in China has really reinforced that the impacts of disease are important and highlights our need to be vigilant and to ensure that biosecurity, hygiene and foreign trade practices are considered at all times,” said Pluske. “It's the last 12 months that have spiked in volatility and disruption of the global pork industry is at a completely new level. As everyone is aware, we are in the midst of a global pandemic, that was identified only 15 months ago.”

The unprecedented combination of ASF and COVID-19 has profoundly changed the dynamics of the global pork industry and business models that once existed, he said.

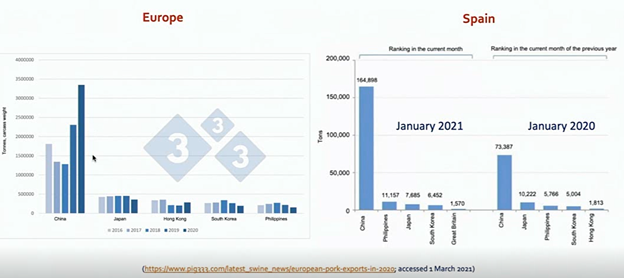

“ASF certainly continues to impact pork production in Asia and Europe, and this has had some significant impacts on global trade flows for pork,” he noted. “The graph on the left-hand side (below) shows total exports from Europe in terms of carcass weight for different years in 2016 through 2020, for a range of different countries: Philippines, South Korea, Hong Kong, Japan, and China.”

The chart above provides an example, showing exports from Spain to countries in January 2020 versus one year later in January 2021 .

“I want to focus your attention on China, the major export destination, but we can see nearly a 250% increase of exports from Spain to China to satisfy that demand,” Pluske explained. “COVID-19 and ASF will keep affecting the supply chain, including producers, abattoir capacity, exporters and importers, and consumers. The global feed crisis and the pork trade will remain heavily impacted by the overall current global uncertainty and it’s likely to continue into the next year or two.”

One of the lessons learned from the pandemic is that it had a huge impact on the way that society orders, purchases, prepares and consumes pork and other foods.

“Some of those challenges, such as balance between restaurant trade, home-prepared and ready meals, will persist into the future,” he said.

Mega Trends in the Pig Industry

Several mega trends will continue to impact and challenge pork production and profitability into the future.

- Food safety - how our food is produced and processed

- Welfare and treatment of animals will always be paramount

- Environmental sustainability and stewardship

- Reduced antibiotic use and enhanced antimicrobial stewardship

“This is the age of consumer empowerment. Consumers will continue to push for greater trust and transparency in farming and farmers, veterinarians and processors, and in the entire food supply chain,” he said. “Bottom line - product or brand expectations amongst consumers will be higher; consumers will increasingly want to feel good about their pork and food choices.”

Animal welfare may come at a cost

Farmers and those who care for farm animals continue to strive to improve the welfare of their animals. This is a given in pork production; it's not negotiable. Improving welfare often requires a change in practice or protocol which can costs money and may act as a deterrent to farmers.

“The converse is there is a risk that doing nothing to improve welfare diminishes the farmer’s social license to operate and raise animals. Therefore, is there a way to assist such businesses facing the dilemma of which practices to change in order to improve farm animal welfare without adversely affecting profitability?” Pluske noted.

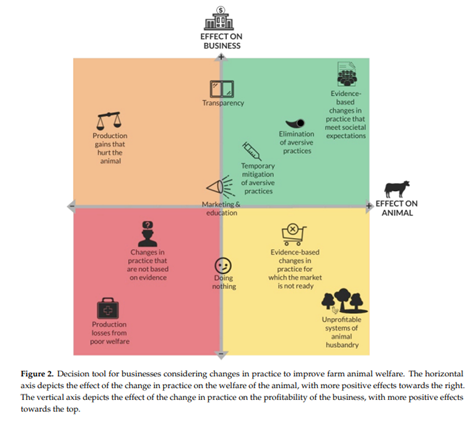

A new paper proposes a decision tool for businesses considering changes in practice to improve farm animal welfare that acts as a guide to assist producers in making evidence-based decisions.

The horizontal axis, running negative (left) to positive (right), shows the effect of a change in practice on animal welfare. The vertical axis depicts the effect of a change in practice on business profitability with a more positive effect (higher profitability) for the business shown towards the top.

“It's the top right-hand corner in green, where we have positive effects on the animal and positive effects on the business,” he explained. “In contrast, the bottom left-hand quadrant where there's negative welfare effects on the animal and negative effects on the business, is not where we want to be. We want to be moving towards this top right-hand quadrant, where there are benefits for both animal welfare and benefits for the business.”

This leads to a question about piglet mortality and morbidity - is this inevitable or is it unacceptable in the future? Given the association between larger liter size and piglet mortality, and the associated sow welfare concerns of larger litters, is it ethical to continue these trends? If management can be optimized and welfare can be improved, how much mortality is then acceptable, he questioned.

Role of early life in reaching the piglet’s full genetic potential

Low birth weight piglets, which are less than 1.1 to 1.2 kilograms, are a challenge for all production systems, especially those that operate on an all-in and all-out basis. They generally have greater pre-weaning death, slower growth rate, a decrease in pork quality and can account for up to 25% of the piglet population. Of course, not all low birth weight pigs remain light throughout life, and some can perform well if managed and fed appropriately.

Many other factors can influence growth from weaning through the slaughter. A recent Australian analysis of the cost of a low birth weight piglet estimated it to be about US$11.50 per pig born alive (AU$15 /€9.70). The cost includes extra days to market associated with extra feed and housing. Plus, there may be additional costs associated with negative impacts on carcass and/or meat quality.

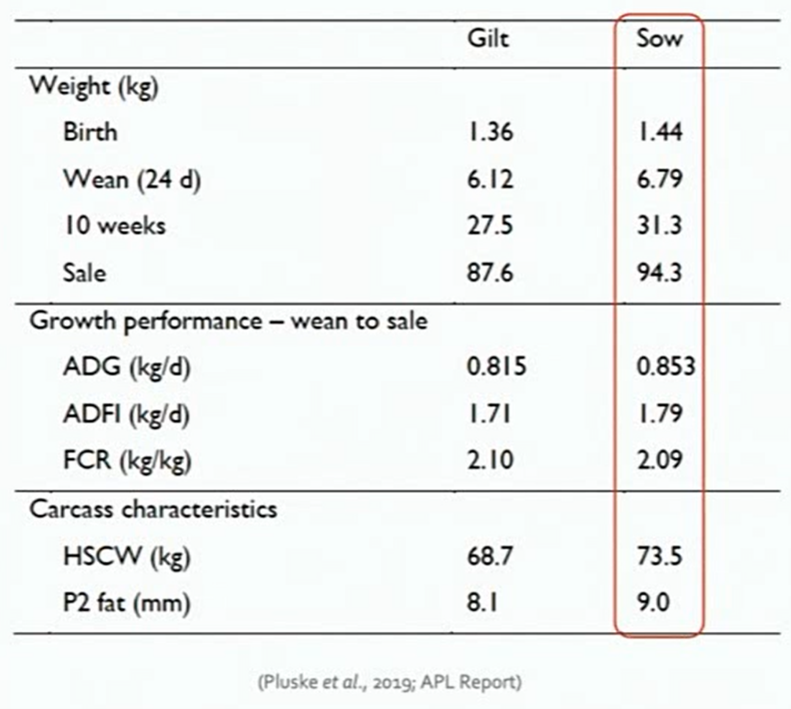

One of the sources of low birth weight piglets is from gilt litters. Several years ago, the Australian pork industry looked at trying to optimize the progeny of first litters, because gilt or first-litter sows comprise a significant proportion of the herd, and the gilt progeny represent a significant production penalty. Compared to progeny born to multiparous sows, gilt progeny are born lighter and wean lighter. They typically have a higher incidence of health problems and mortality and take longer to reach a sellable market weight.

A collection of data from two production systems in Australia compares gilts and sows (chart right). When it comes to weight, gilt progeny at the same age are lighter at all time points, and they tend to grow slower.

“Just because they are lighter does not mean that they are any less efficient necessarily in converting food and actually can attain a sale weight in a reasonable length of time,” he noted.

What do gilt progeny cost? Part of the same project looked at margin over feed costs - the margin between revenue normalized to one kilogram of the carcass price and feed costs, which provides an estimate of profitability.

“At the time that this particular study was done across two of Australia's largest vertically integrated operations, the difference in margin over feed cost of gilt progeny versus sow progeny, was around AU$6 to $10 per slaughter pig in favor of sow progeny,” he said. “Therefore, gilt progeny cost somewhere in the vicinity of US$4.60 to US$7.50, or €$3.80 to €$6.30. This provides a further indication about what some of the production penalties associated with low birth weight piglets might be.”

The pork industry is extremely resilient, but it must continue to adapt and evolve to face the disruptions and challenges ahead, like the increasing pressure for the pork industry to be sustainable. Survival in the industry means to focus or refocus on the basic principles of pork production, like biosecurity and hygiene, husbandry and management, welfare and environment, nutrition and immunity, new technology, all while reducing costs and increasing revenue and meeting the increasing demands of societal expectations around farming and pork farming.

“The critical importance of sow and piglet nutrition during gestation, after parturition and after weaning cannot be underestimated, but there needs to be an evaluation of the economic assessment of practices and interventions through whole-of-life and whole-of-herd performance,” Pluske said. “In this respect, research and development is critical to face the challenges and improve businesses into the future.”

To watch the full presentation by Dr. Pluske, go here: https://zcene.nepgroup-webinars.com/lifestart-swine-online-conference-1