Pig outlook: Lean hog futures bears gain control

Livestock analyst Jim Wyckoff shared this week's global pig newsOctober lean hog futures prices have slumped and hit a six-week low as the bears have gained the near-term technical advantage, to suggest more downside price pressure in the near term. Fundamentally, the US cash hog market has deteriorated. Wholesale pork prices have turned lower. Carcass values Wednesday at midday fell 96 cents to $107.67 on 141.96 loads. Losses were widespread, though picnics and ribs both saw gains. This is the lowest quote for wholesale prices since the first week of July. More of the same is likely in the coming weeks as slaughter rates rise seasonally and consumer demand is diminished by the looming end to the grilling and BLT seasons.

Weekly USDA export sales for US pork, beef

Beef: US net sales of 15,100 MT for 2023 were up 2 percent from the previous week, but down 13 percent from the prior 4-week average. Increases were primarily for South Korea (4,600 MT, including decreases of 400 MT), China (3,200 MT, including decreases of 100 MT), Japan (2,700 MT, including decreases of 300 MT), Mexico (1,600 MT, including decreases of 100 MT), and Taiwan (700 MT, including decreases of 100 MT). Total net sales of 100 MT for 2024 were reported for Japan. Exports of 15,800 MT were down 2 percent from the previous week and 4 percent from the prior 4-week average. The destinations were primarily to South Korea (4,200 MT), Japan (3,500 MT), China (2,800 MT), Mexico (1,600 MT), and Taiwan (1,100 MT).

Pork: US net sales of 28,700 MT for 2023 were up 29 percent from the previous week and 36 percent from the prior 4-week average. Increases were primarily for Mexico (9,400 MT, including decreases of 300 MT), Japan (4,900 MT, including decreases of 200 MT), China (3,500 MT, including decreases of 100 MT), Canada (3,100 MT, including decreases of 400 MT), and South Korea (3,000 MT, including decreases of 1,000 MT). Total net sales of 2,800 MT for 2024 were for South Korea. Exports of 28,600 MT were up 7 percent from the previous week and 11 percent from the prior 4-week average. The destinations were primarily to Mexico (13,100 MT), China (3,600 MT), Japan (3,300 MT), South Korea (2,400 MT), and Canada (1,700 MT).

Tyson plans to sell China poultry unit

Tyson Foods plans to sell its China poultry business, Reuters reported, citing people with knowledge of the situation. The company has reportedly hired Goldman Sachs to advise on the sale and sent preliminary information to potential buyers, including a number of private equity firms. The sources did not say why Tyson was planning to sell the business.

Higher Chinese hog prices expected in H2

Chinese pork processing giant WH Group Ltd expects hog prices in China to rise 10% to 20% in the second half of 2023 from the first six months, supported by stronger demand and smaller supply glut. The head of WH Group forecast the median hog price to reach about 16 yuan ($2.20) per kilogram (kg) in the second half of this year, up from an average of 15.12 yuan in the first half, but the average 2023 price would still be significantly lower than 2022. WH Group executives also said the recent heavy rains and flooding in northern China did not affect its production.

Plant-based meat alternatives struggle to maintain early momentum

Despite initial strong interest, the market for plant-based meat alternatives in the U.S. is facing challenges in maintaining momentum, according to a new report from CoBank’s Knowledge Exchange. Higher prices compared to traditional meat products have led to a decline in repeat purchases by consumers. The price differential, along with lingering negative perceptions about taste, value, and versatility, remain obstacles for the plant-based meat category, the report notes.

Plant-based meat sales surged in 2020 due to consumer curiosity and increased discretionary income during pandemic-induced food shortages. However, less than half of those who initially tried plant-based products continued purchasing them, according to consumer research firm Mintel.

Sales of meat alternatives have steadily decreased since 2021, with a sharp decline in the past year. Volume sales dropped by 20.9% for the 52-week period ending in July 2023, based on data from Circana, a consumer behavior research firm.

For the plant-based meat category to regain traction, the report says, diversification of formats is crucial. While frozen and refrigerated options still dominate, shelf-stable varieties have seen growth, increasing by 82% in 2022. These products, such as plant-based versions of tuna, ham, and chicken, offer convenience and appeal to a broader audience.

High prices have limited the penetration of plant-based products to higher-income households, typically around 10% of households. To achieve wider adoption, according to the report, the category needs innovation in terms of product diversity and scalability. Health and environmental concerns have driven interest, especially among younger consumers. However, addressing price, convenience, and familiarity will be pivotal for the success of plant-based alternatives.

GOP senators introduce bill to prevent EPA's animal agriculture emissions reporting

Sens. Roger Marshall (R-Kan.) and Deb Fischer (R-Neb.) proposed legislation aimed at preventing the Environmental Protection Agency (EPA) from requiring livestock and poultry producers to report air emissions arising from animal waste. The bill outlines that emissions from animal waste would be exempt from the Emergency Planning and Community Right-to-Know Act (EPCRA). While an exemption from the EPCRA was previously established through regulations, the ag sector has sought to enshrine this exemption into law. Sen. Marshall stated that this legislation clarifies that low-level livestock emissions, which constitute less than 4% of total U.S. greenhouse gas emissions, are not information essential or valuable to first responders. The bill is supported by 15 other Republican senators and enjoys backing from numerous agricultural and livestock organizations.

USDA Monthly WASDE report for August

LIVESTOCK, POULTRY, AND DAIRY: The forecast for 2023 US red meat and poultry production is reduced from last month on lowered beef, pork, and broiler forecasts. Beef production is lowered on lower steer and heifer slaughter and lighter dressed weights although cow slaughter is increased. Pork production reflects lighter dressed weights although slaughter is raised slightly. Broiler production is reduced on lower expected eggs set and continued relatively low hatchability.

US pork production is unchanged from last month. Growth in broiler production is slowed with lower prices expected to reduce producer margins. The slower pace of egg production growth in 2023 is expected to carry into early 2024. Beef imports for 2023 are adjusted to reflect recent trade data but no change is made to the forecasts for second-half 2023 or 2024. The beef export forecast is unchanged for 2023. Exports are raised for 2024 from last month on higher expected supplies of beef. Pork imports and exports are adjusted to reflect June data, but no change is made to the forecasts for the remainder of 2023 or 2024. Broiler exports are reduced for 2023 and 2024 on lower expected production. Turkey exports are raised on lower expected prices.

The next week’s likely high-low price trading ranges:

October lean hog futures--$76.00 to $82.00 and with a sideways-lower bias

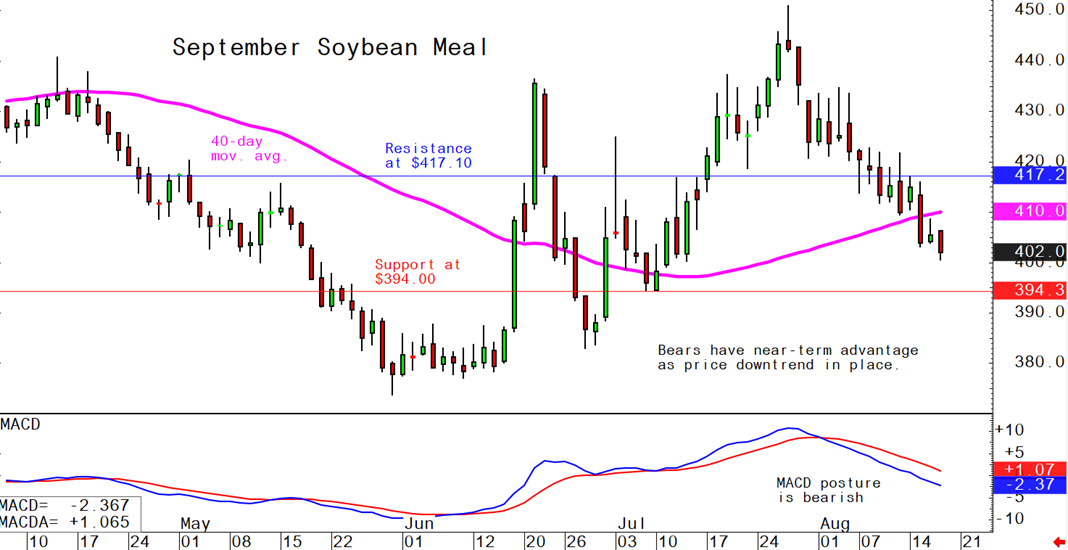

September soybean meal futures--$390.00 to $420.00, and with a sideways-lower bias

December corn futures--$4.70 to $5.10 and a sideways-lower bias

Latest analytical daily charts lean hog, soybean meal and corn futures