Weekly pig report: Lean hog futures still trending up, but bulls tire

Lean hog futures pushed to new contract highs this week, though profit-taking and technical suggest the rally may be losing momentum.

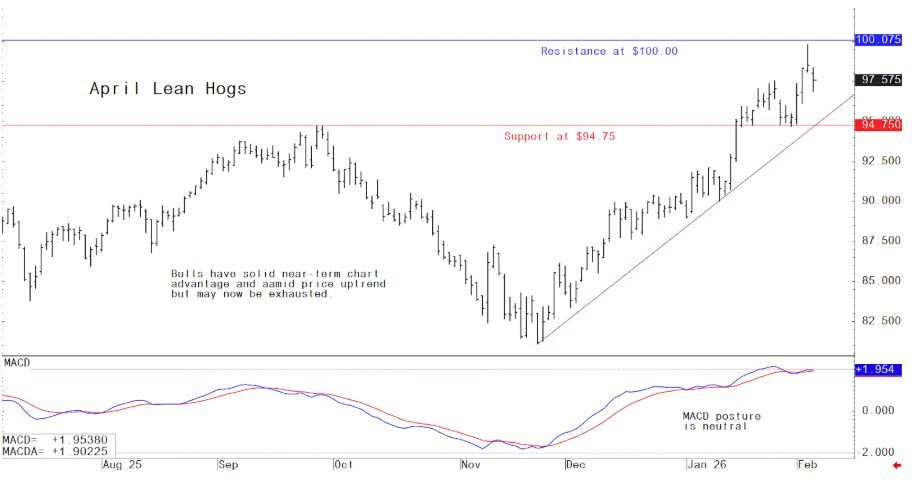

Lean hog futures prices are in solid uptrend, but the bulls may be exhausted. April lean hog futures on Wednesday rose 30 cents to $98.45, nearer the session low and hit a contract high early on. Hogs saw some profit-taking pressure after hitting a new contract high. Wednesday’s low-range daily close does hint the hog market bulls may now be near-term exhausted after this week’s good gains. April futures’ big premium to the cash market suggests futures traders believe there is more upside for the cash hog market in the coming weeks. The latest CME lean hog index is up 12 cents at $85.83. Today’s projected cash index price is up 23 cents at $86.06. The national direct five-day rolling average cash hog price quote Wednesday was $62.81.

Pork Industry and related news

Weekly USDA US pork export sales

Pork: Net US sales of 35,100 MT for 2026 were down 37 percent from the previous week and 48 percent from the prior 4-year average. Increases primarily for Mexico (13,800 MT, including decreases of 8,100 MT), China (5,200 MT, including decreases of 300 MT), Canada (4,700 MT, including decreases of 300 MT), Japan (4,000 MT, including decreases of 2,900 MT), and South Korea (2,600 MT, including decrease of 1,400 MT). Exports of 37,600 MT were up 5 percent from the previous week and 6 percent from the prior 4-week average. The destinations were primarily to Mexico (16,900 MT), Japan (4,300 MT), South Korea (3,800 MT), Canada (3,300 MT), and China (3,000 MT).

The next week’s likely high-low price trading ranges:

April lean hog futures--$96.00 to $100.00 and with a sideways bias

March soybean meal futures--$290.00 to $310.00, and with a sideways-higher bias

March corn futures--$4.24 to $4.34 and a sideways-higher bias

Latest analytical daily charts lean hog, soybean meal and corn futures