H1 2020 Review: China’s rapidly shifting pork import market under COVID-19

Angela Zhang, Head of Business Intelligence Division at IQC Insights, deeply reviewed and forecast China’s rapidly changing pork import market 2020 based on its domestic supply and demand situation as well as the performance of global pork exporters, major plants and widely differentiated pork products.Part of Series:

< Previous Article in Series Next Article in Series >

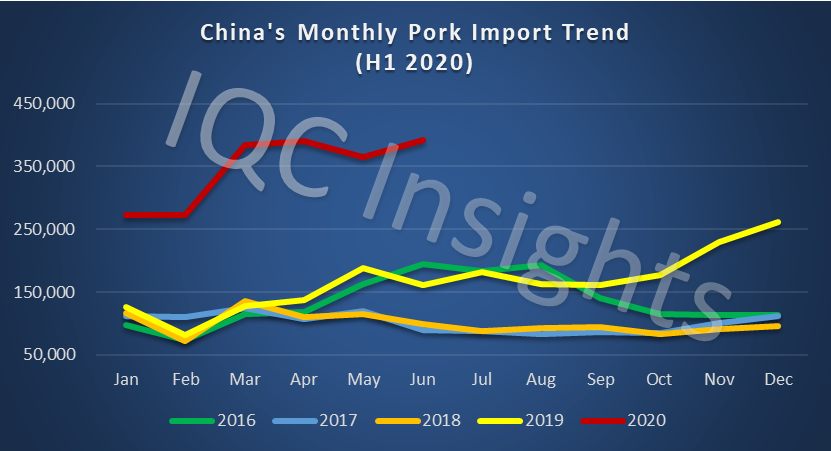

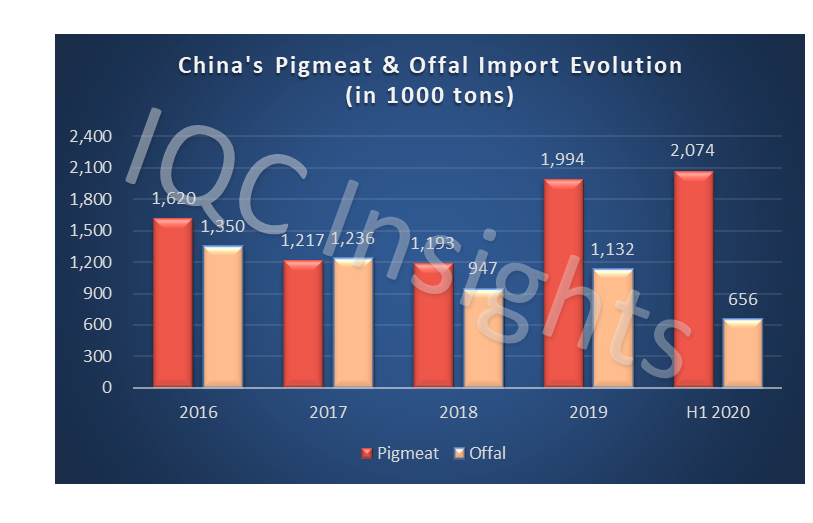

Following the upward trend in 2019, China’s pork import market went higher in the first half year of 2020. Despite the spreading COVID-19 pandemic and subsequent weak pork demand especially in the foodservice sector, China imported 2,074,128 tons of pigmeat and 656,344 tons of pork offal in total from this January to June, increasing by 153.3% and 33.2% respectively on a y-o-y basis.

It seems that the reduced pork consumption demand did not cast a shadow over China’s pork import market at all. The pigmeat import volume in the first six months of this year has exceeded that of the full year in 2019. This could be attributed to the plunging pork production in the first half of 2020 due to the impacts of ASF, and the relatively lower pork prices in overseas markets during the same period.

China’s pork import market H1 2020: running on a high position

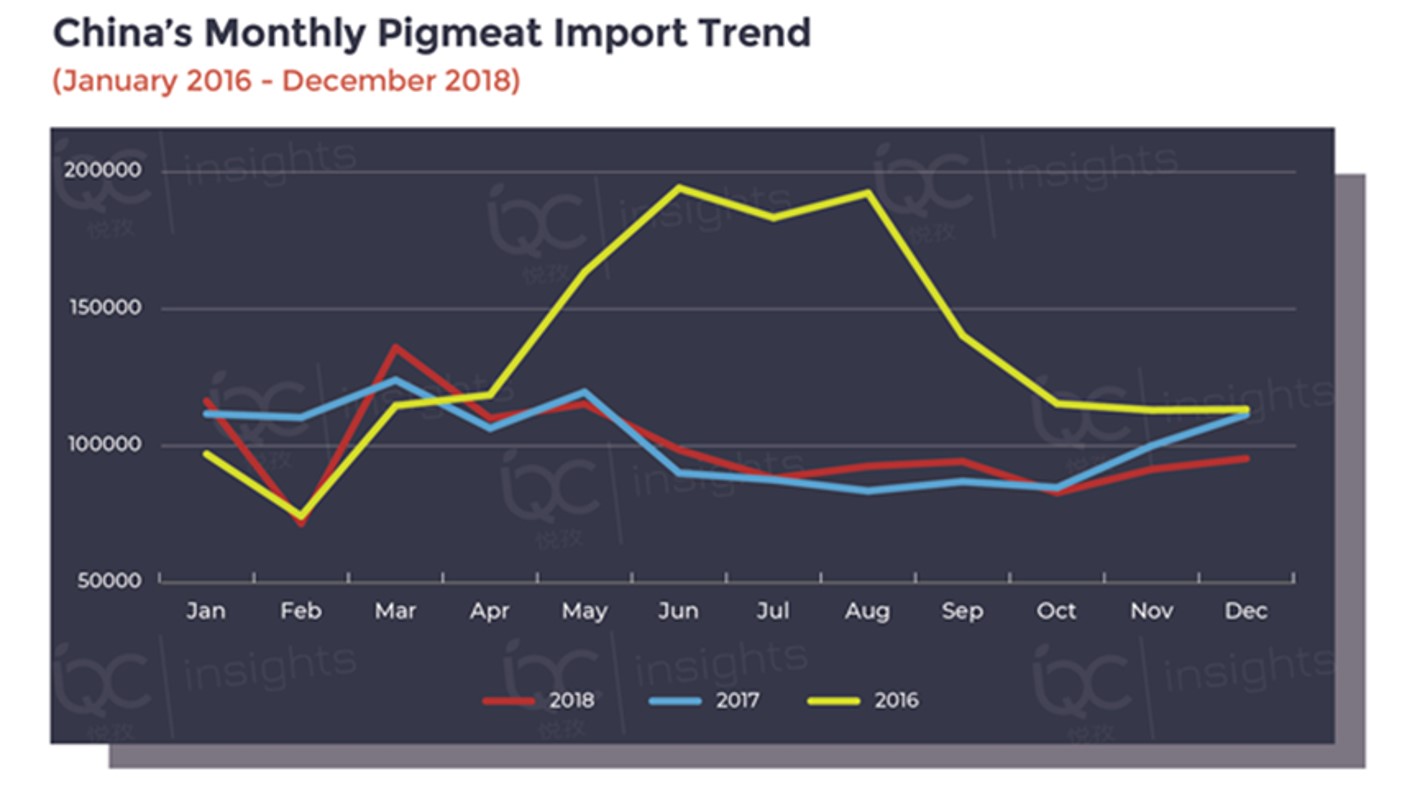

As shown in the following chart, China’s pork import volume remained stubbornly high throughout the first six months of this year. Especially for this March and April, the y-o-y growth rate reached 201.9% and 185.6% to 384,015 tons and 389,891 tons respectively.

Internally, the major growth driver is the domestic large supply gap for pork. Due to the negative impacts of ASF, China’s annual pork production declined by 21.3% to 42.55 million tons in 2019. When it comes to 1H 2020, the recovery in pork production is still slow. The domestic pork production continued with the downward trend in the first six months of this year, decreasing by 19.1% y-o-y to 19.98 million tons. Consequently, the expectation for the supply-demand imbalance in the future market stimulates China’s pork importers to purchase and stock more pork from overseas markets than previous years.

© IQC Insights

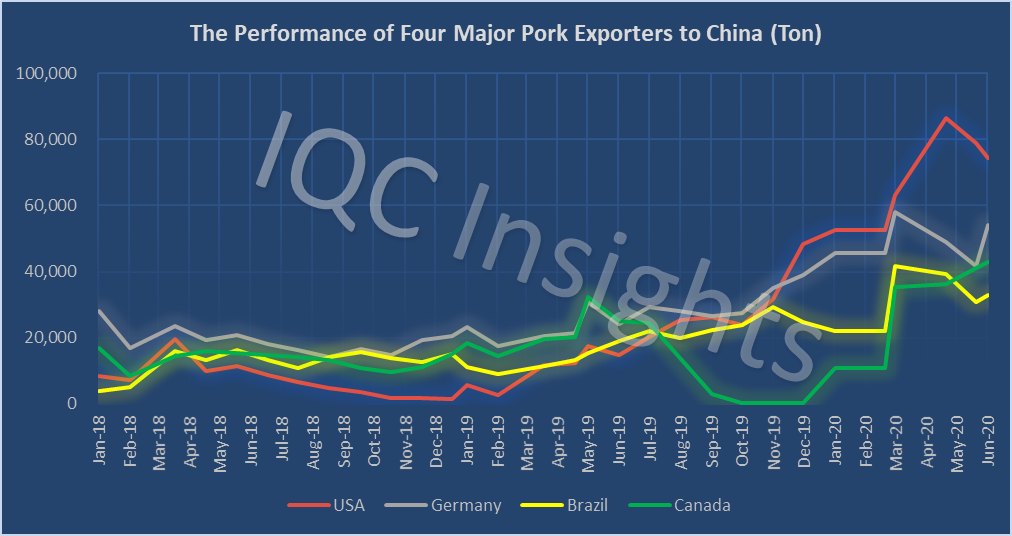

Externally, the rapid increase of USA’s pork export to China from this January to June is another significant driving force for the explosion of China’s pork import volume. China totally imported from USA 407,896 tons of pigmeat and 130,061 tons of pork offal during this period, growing by 503.3% and 85.6% respectively on a y-o-y basis.

© IQC Insights

In terms of the product portfolio, the blowout of the pork import market since last October was primarily driven by the pigmeat subsection (e.g. shoulders, legs, bellies and collars), secondarily by offal products. The major reason is, China has been the major destination for offal products before the ASF outbreak, while more pigmeat products were transferred from European and Southeast Asian markets (e.g. Japan and South Korea) to China, driven by China’s large supply gap and expected soaring pork prices.

The performance of global pork exporters to China: a fiercer zero-sum game

The competition among global pork exporters to China is a zero-sum game in nature, and it got fiercer in the first half of 2020. The biggest winner was USA, although its pork industry was struggling with both internal COVID-19 and external trade war. Besides retaining its championship in pork offal, USA also retook its market share in the pigmeat section from other exporters and returned to the long-lost Number one. Such significant increases were mainly achieved under the following factors:

- More American pork producers are pushed to remove ractopamine to meet stricter Chinese regulations since last October. Namely, more plants have been qualified for pork export to China from then on.

- Due to the outbreak of COVID-19 in USA, dozens of meat processing plants were closed when more than 3,000 workers sickened, leading to at least 25% decrease in USA’s pork and beef processing capacity. As a result, farmers have to euthanize millions of pigs to avoid overstock since this April, or more economically, accelerate their pork export to China in a more competitive price than other countries.

- USA’s phase one trade deal with China helps and motivates its farmers to nab and reinforce their market share, both in China’s pigmeat (19.7%) and pork offal (19.8%) in the first half of this year, despite the currently ongoing political tensions between these two nations.

© IQC Insights

Opposite to USA, Canada lost nearly half of its market share to other exporters both for pigmeat and offal products from this January to June. As shown in the above chart, Canadian pork exporters suffered a vertiginous drop within the four months of September to December 2019. The major reason is Canadian pork plants were suspended to export to China because of counterfeit veterinary health certificates attached to pork products since June 25, 2019. Although the ban was lifted from November 5 2019 on, it continues to make a far-reaching impact on the first half of 2020. Among all pork exporters, Canada achieved the lowest y-o-y growth rate in pigmeat (35.8%) and highest decrease rate in pork offal (-24.2%) from this January to June. Meanwhile, its ranking in pigmeat and offal products also fell from the 3rd to 6th.

COVID-19: more disruptive than African Swine Fever on overseas meat plants

When African Swine Fever (ASF) broke out and spread since later 2018 in Asia, the European and American pork producers regarded this virus as very grave. They resorted to every conceivable means to protect their plants from ASF. However, for COVID-19, some producers let down their guard, attaching more importance to its impacts on the pork consumption than the supply chain of the whole pork industry.

As numerous employees in European and American meat plants tested positive, more and more overseas pork producers have to limit or pause their operations since this April. To make matters worse, the COVID-19 virus was discovered on chopping boards used for imported salmon at Xinfadi, Beijing’s largest agricultural wholesale market later this June. Consequently, China launched massive nucleic acid tests not only for working staff in wet markets, but also for samples of imported seafood and meat products.

In addition, more than 40 overseas meat plants have suspended export to China from this June on, either proactively or passively. Among these plants, 61% are those exporting pork to China, while the remaining are for beef, poultry and mutton export.

Geographically, the ban list consists of 15 countries, 47% from Europe, 20% from South America, 13% from North America and Oceania respectively, and 7% from Central America. Nevertheless, when assessing the subsequent effects, it is not the number of banned plants on each continent acting as the determining factor, but their market share in China.

Among these banned pork plants, the suspension of German Plant 202 and Dutch Plant 28 imposed greater impacts on China’s pork import market than other exporters, because of their larger export volume and long-established customer base in China.

Imported pork products: widely differentiated performance from each other

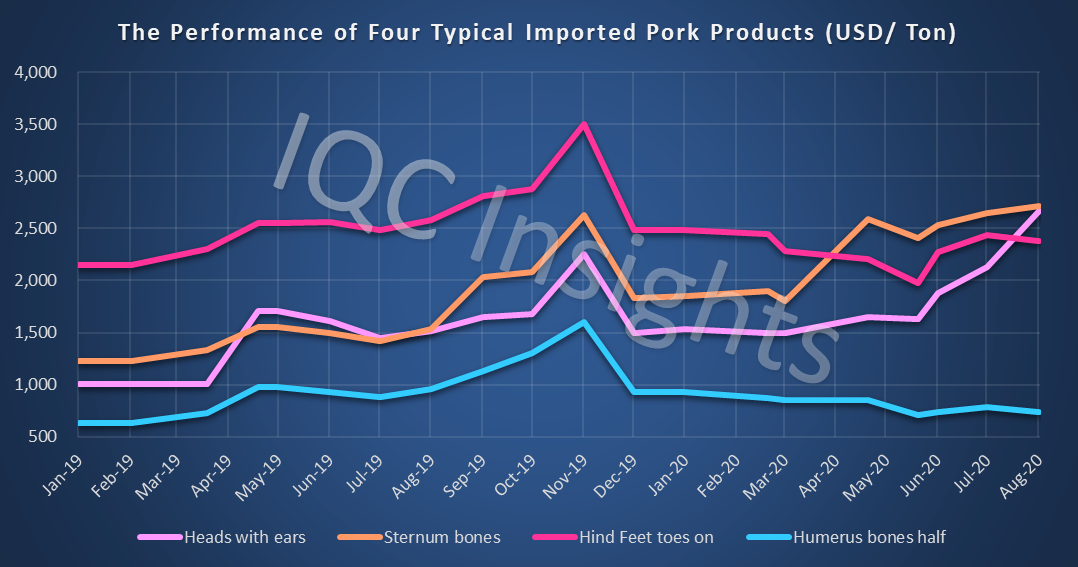

Although China’s pork import market, as a whole, is unprecedentedly thriving, the performance or price evolution of each imported pork product is quite different from each other especially from this March on.

© IQC Insights

Pig heads with ears have particularly stood out of all products in China’s pork import market by the end of this August, with a high y-o-y growth rate of 91%. The major driving force is the much lower inventory level of heads than ever before. As shown in the above chart, pig heads slumped last November and December, causing at least 30% loss for those importers and wholesalers in pursuit of high. Correspondingly, when the market bounced back this June, they cautiously adopted the pre-sale strategy, nearly without any stock. The short supply of pig heads was intensified when the demand for heads from processing and foodservice industries recovered, making the head price hit a record high.

In contrast to heads, humerus bones-half have performed badly during the same period. Even in a bull market, its price still declined by 23.3% by the end of this August. Although this product has followed a similar trend to heads in the early stage, their divergence occurred this June. This could mainly be attributed to the weak demand for humerus bones-half from its single channel of foodservice industry and moreover, geographically concentrated in some eastern and southern provinces. As a result, the piled-up stock drove down its price.

However, not all bone products were on a downward trend. Taking sternum bones as an example, its price greatly increased by 77.1% this August, compared with that of last August. The growth factors include: 1). diverse recipes and channels for restaurants and supermarkets; 2). The meaty sternum bones could replace spareribs or riblets when the price of the latter is soaring; 3). Less supply of sternum bones from overseas plants this year.

Forecast

Looking forward to the future of China’s pork import market, the key factors below would influence its supply and demand balance in the next few months:

On one hand, the significant reduction in domestic pork production stimulated China’s pork import. Consequently, the pigmeat import volume in H1 2020 surpassed the total volume of the whole year in 2019. For the second half of 2020, the domestic pork production is expected to recover, but it would still fall short of the normal level by the end of this year.

In addition, from this January to early September, a total of 540,000 tons of frozen pork reserve has been released to local markets in 31 batches to curb the pork price. Even compared with the full year of 2019, the released volume in the first eight months of this year has increased by 285.7%. More importantly, according to its production date of the latest batch, we can assume that there are still enough or large stock of frozen pork to be released in the remaining months of this year, negative news for the import market.

On the other hand, as COVID-19 is well under control in China now, the pork consumption from restaurants, schools and enterprises also start to recover vigorously. Furthermore, the forthcoming three of China’s most important festivals (Mid-Autumn Festival & National Day in September and October, Spring Festival in December and next January) would also greatly boost domestic pork consumption.

Nevertheless, a recent campaign against food waste nationwide could somewhat inhibit such growth, when consumers are encouraged to order or cook less dishes to avoid waste. Also, a big wild card is when COVID-19 can be well controlled worldwide and whether there would be a second-wave in the future.

To sum up, in China’s rapidly-changing pork import market 2020, it is the best of times for those correctly appraising the situation; it is the worst of times for those missing the boat.

As reported by Angela Zhang